WTI Crude Oil Commodity Elliott Wave Analysis

WTI Crude has shown gains in August 2024 following a sell-off in July, although it has been trading within a range since March 2023. The current rally may encounter resistance below $85, potentially prompting sellers to step in again.

WTI Elliott Wave Technical Analysis: Long-Term Outlook

In the long term, WTI Crude remains in a corrective phase, retracing the bullish impulse that occurred between April 2020 and March 2022. This correction seems to be forming a double zigzag pattern, labeled as waves W-X-Y of the primary degree. Wave W (circled) completed in March 2023 with a zigzag structure, after which the price has moved sideways without a clear breakout. From an Elliott Wave perspective, this sideways movement appears to be forming a triangle pattern for wave X (circled).

Daily Chart Analysis

On the daily chart, WTI has completed waves A, (B), (C), and (D) of wave X (circled). The ongoing rally from the August 2024 low is likely part of wave (E), expected to complete wave X (circled). Wave (E) is anticipated to finish as a corrective structure, most likely in a zigzag pattern.

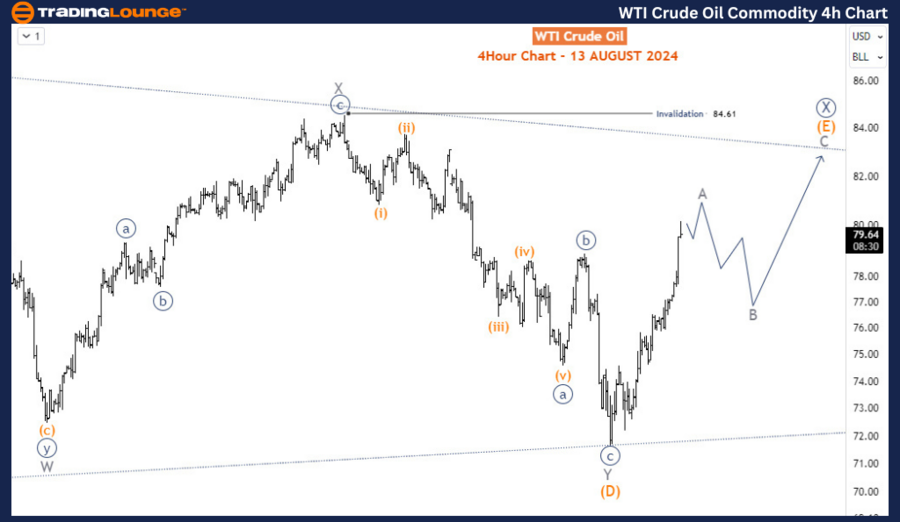

H4 Chart Analysis

The H4 chart indicates that the current rally is clearly an impulse wave, labeled as wave A of (E). Once wave A concludes, a pullback for wave B is expected, followed by further rallies to complete wave C of (E). As long as the 84.6 invalidation level remains unbreached, the long-term outlook stays bearish. However, the short-term rally is likely to continue.

Conclusion

WTI Crude is currently in a short-term rally that may face resistance below $85. Although the broader outlook remains bearish, this rally is expected to complete wave (E) of X (circled) before the market resumes its downward trend. Traders should monitor for a pullback after wave A concludes, as this could present opportunities for short-term gains before the larger downtrend continues.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support