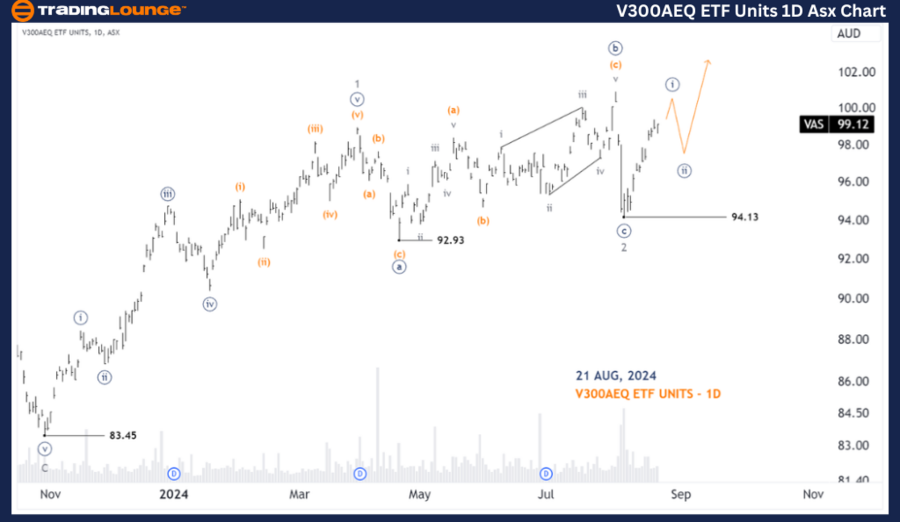

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis and Trading Outlook (1D Chart)

Greetings, our latest Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with V300AEQ ETF UNITS – VAS. The current pattern suggests VAS might begin a bullish movement with a 3-grey wave formation.

VAS Elliott Wave Technical Analysis (1D Chart)

ASX: Vanguard Australian Shares Index ETFA

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

-

Function: Major Trend (Minor degree, grey)

-

Mode: Motive

-

Structure: Impulse

-

Position: Wave ((i))-navy of Wave 3-grey

-

Details: Wave 3-grey is currently unfolding to push higher. It is subdividing into wave ((i))-navy, which may extend upward shortly before concluding, after which wave ((ii))-navy is expected to push lower.

- Invalidation Point: 94.13

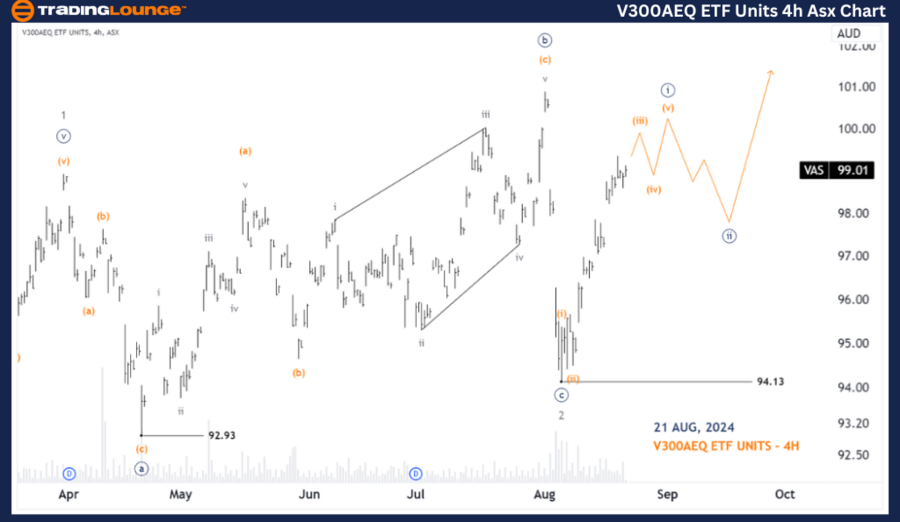

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Analysis (4-Hour Chart)

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

-

Function: Major Trend (Minute degree, navy)

-

Mode: Motive

-

Structure: Impulse

-

Position: Wave (iii)-orange of Wave ((i))-navy

-

Details: Since the low at 94.13, the ((i))-navy wave is unfolding, subdividing into (i), (ii), (iii), (iv), (v)-orange waves. This structure is expected to continue pushing slightly higher to complete the ((i))-navy wave. Subsequently, wave ((ii))-navy may unfold with a downward move, after which the uptrend is likely to resume with the continuation of the ((iii))-navy wave. A Long Trade Setup could be considered with the formation of the ((ii))-navy wave.

-

Invalidation Point: 94.13

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: REA GROUP LTD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis and short-term outlook for ASX: V300AEQ ETF UNITS – VAS aim to equip traders with actionable insights into the current market trends. By providing specific price levels as validation or invalidation points for our wave count, we enhance the reliability of our forecast. This approach ensures that our readers receive a clear, objective, and professional perspective on the ongoing market dynamics.