ASX: WiseTech Global Limited - WTC Elliott Wave Technical Analysis (1D Chart)

Welcome to our comprehensive update on WiseTech Global Limited (WTC) listed on the Australian Stock Exchange (ASX). Our latest Elliott Wave analysis indicates that WTC.ASX may be on the cusp of a significant upward surge, driven by the emerging ((iii))-navy wave.

ASX: WiseTech Global Limited - WTC Elliott Wave Technical Analysis

WiseTech Global Limited (WTC) 1D Chart (Semilog Scale) Analysis

Trend: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey of Wave (3)-orange of Wave ((1))-navy

Details: The ((iii))-navy wave is poised to push prices higher, with a target at the 146.44 mark. To maintain this bullish outlook, the price must remain above 83.11.

Invalidation Point: 83.11

ASX: WiseTech Global Limited - WTC Elliott Wave Analysis (1D Chart)

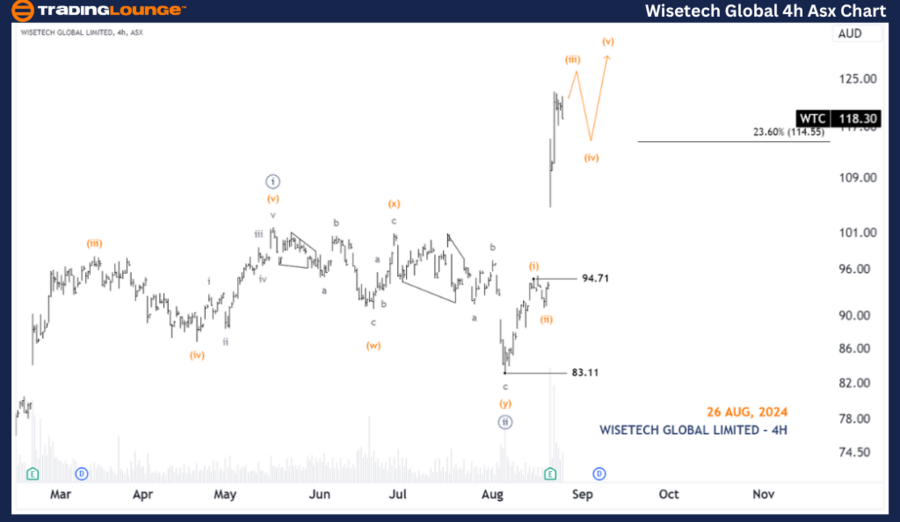

ASX: WiseTech Global Limited - WTC 4-Hour Chart Analysis

Trend: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Details: Originating from the 83.11 low, the ((iii))-navy wave is propelling prices upward, currently subdividing into wave (iii)-orange. Although wave (iii)-orange might extend further, the upside potential appears limited due to its significant advance. Subsequently, wave (iv)-orange may lead to a slight pullback before wave (v)-orange resumes the upward momentum. A drop below 114.55 would signal the onset of wave (iv)-orange.

Invalidation Point: 94.71

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: NATIONAL AUSTRALIA BANK LIMITED Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis and short-term forecast for ASX: WiseTech Global Limited (WTC) offer traders a detailed understanding of current market dynamics, enabling strategic trading decisions. We provide specific price points as validation or invalidation signals to strengthen the confidence in our wave count. We aim to deliver a precise and professional perspective on market trends by integrating these elements.