V Elliott Wave Analysis for Visa Inc. (V) Stock

This Elliott Wave analysis examines Visa Inc. (V) using both the daily and 1-hour charts, offering a comprehensive outlook on the current market trend, structure, and significant price levels.

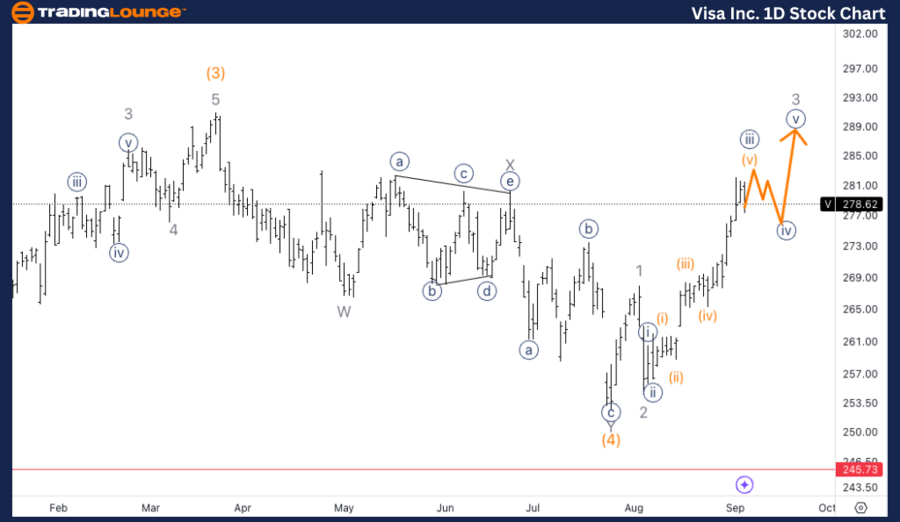

V Elliott Wave Analysis: TradingLounge Daily Chart

Visa Inc. (V) Daily Chart Analysis

V Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 3

Direction: Upside into wave 3

Details: The subdivision within wave {iii} appears to have formed a five-wave move, signaling the potential completion of wave {iii}. Visa's price has approached the critical level of Minor Group 2 at $280, which may mark the top of wave {iii}.

Visa Stock Elliott Wave Analysis

Visa is currently advancing in wave {iii} of 3, characterized by a clear five-wave subdivision. As the stock approaches the Minor Group 2 level at $280, a significant resistance area, wave {iii} is likely nearing completion. Following this, a corrective phase in wave {iv} could unfold, offering the market a consolidation opportunity before resuming the upward momentum in the next wave.

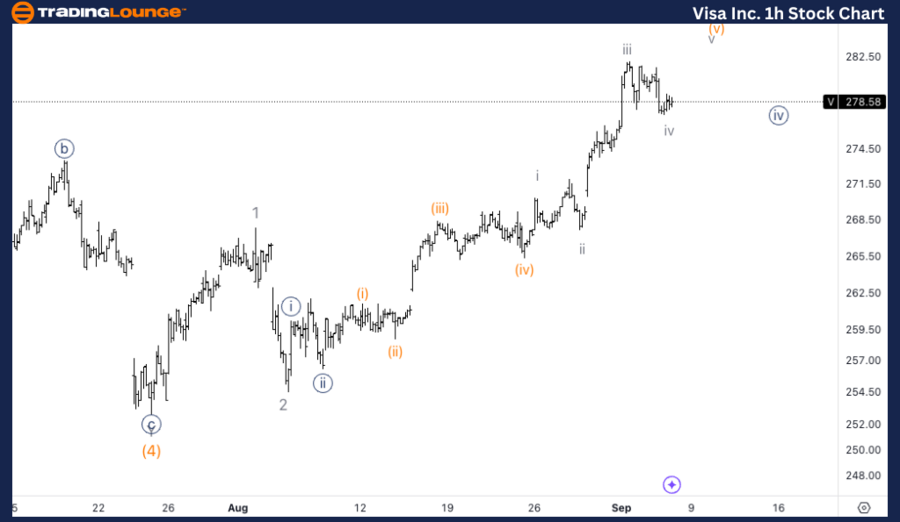

V Elliott Wave Analysis: TradingLounge 1-Hour Chart

Visa Inc. (V) 1-Hour Chart Analysis

V Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave iv of (v)

Direction: Upside in wave (v)

Details: Wave iv of (v) is in progress, with Visa consolidating just below the critical $280 level, a Classic Trading Level. Upon completing wave iv, Visa is expected to move higher into wave v of (v), with the potential to surpass the $280 resistance level.

Visa INC Technical Analysis

Visa is currently in wave iv of (v) within the larger wave {iii}. The price is consolidating near the $280 Classic Trading Level. After wave iv completes, a bullish continuation is expected in wave v of (v), with a possible break above the $280 level. Such a breakout would confirm the strength of the uptrend, signaling further bullish potential for Visa.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: PayPal Holdings Inc. (PYPL) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support