Pepsico Inc., Elliott Wave Technical Analysis

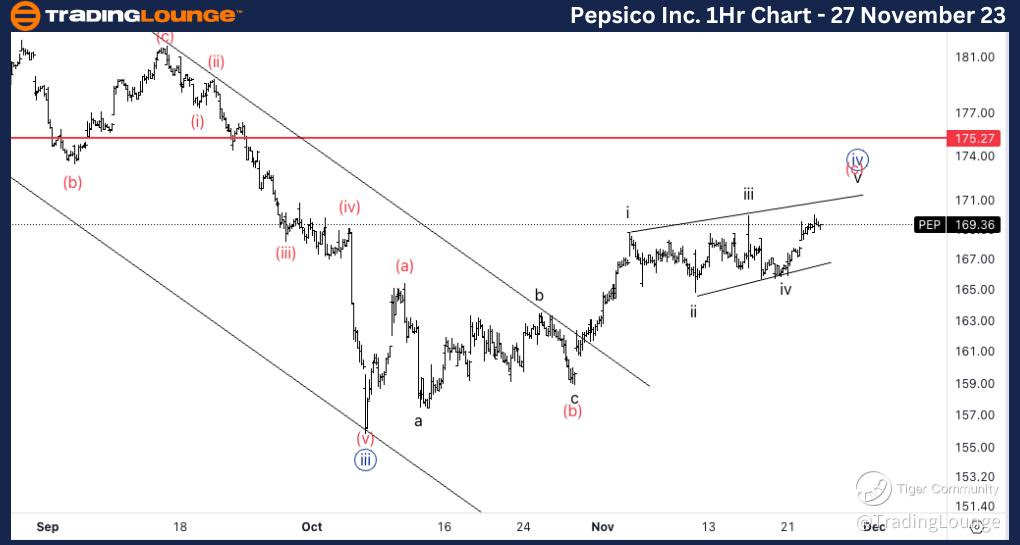

Pepsico Inc., (PEP:NASDAQ): 4h Chart 27 November 23

PEP Stock Market Analysis: Looking for a potential wave {iv} that keep moving in the opposite direction, which is why we are considering either a diagonal into wave (c) or else we could most likely be in a complex correction and we are moving towards invalidation level.

PEP Elliott Wave Count: Wave (c) of {iv}.

PEP Technical Indicators: Below 20EMA.

PEP Trading Strategy: Looking for shorts after bearish confirmation.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

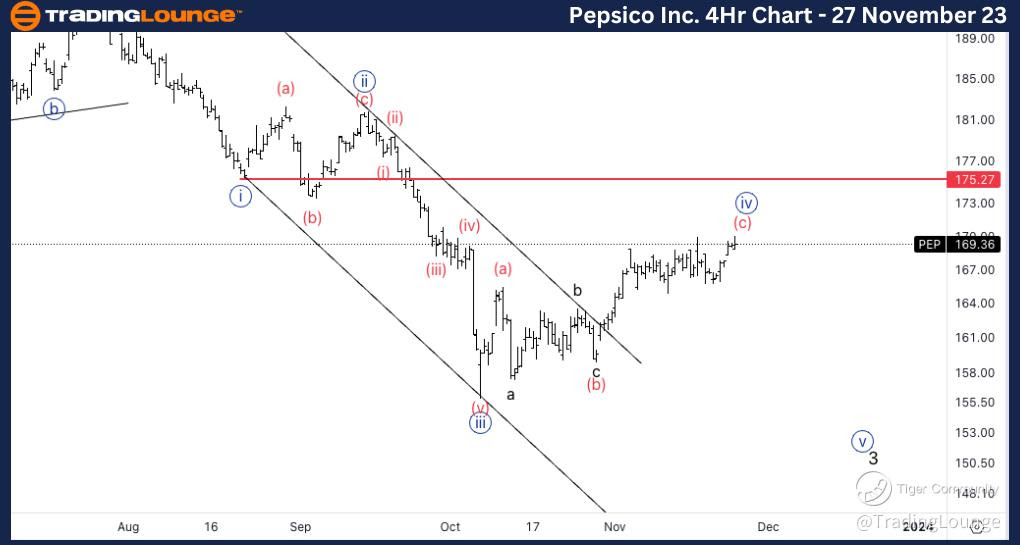

Pepsico Inc., PEP: 1-hour Chart 27 November 23

Pepsico Inc., Elliott Wave Technical Analysis

PEP Stock Market Analysis: Looking for a potential diagonal into wave (c) as we are also starting to form RSI divergence.

PEP Elliott Wave count: Wave v of (c)

PEP Technical Indicators: Above all averages.

PEP Trading Strategy: Looking for shorts after bearish confirmation.