Natural Gas Elliott Wave Technical Analysis

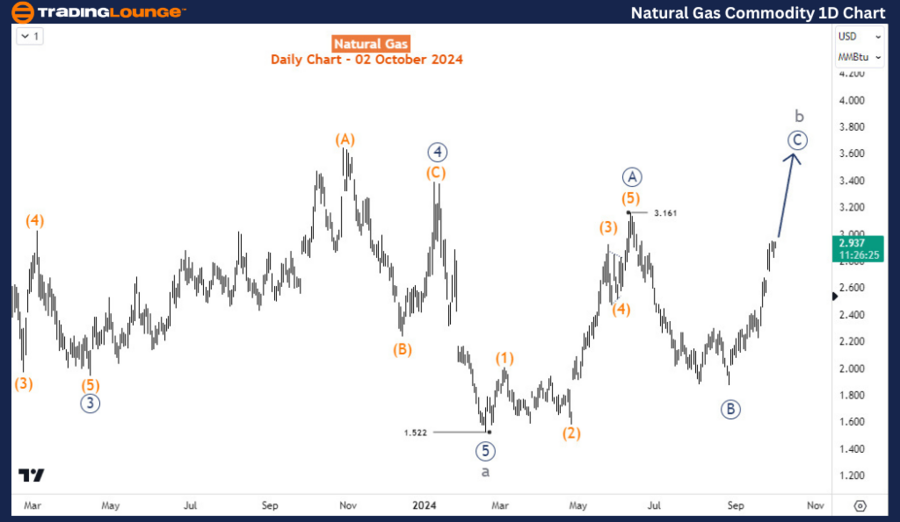

Natural Gas is rapidly recovering from its late August low. The commodity is approaching key highs seen in June and January 2024, as well as the late October 2023 high, and is likely to surpass or match these levels in the upcoming weeks. However, this bullish trend that started in October 2023 is part of a larger bullish correction from the February 2024 low. As long as the bullish correction continues, short-term traders may find buying opportunities during pullbacks until the price reaches the resistance zone of 2.65-3.37.

Natural Gas Commodity Elliott Wave - Daily Chart Analysis

On the daily chart, the current price action is a correction of the bearish impulse wave that started from the high of August 2022 when Natural Gas was trading near $10. This impulse structure is labeled as wave a of the cycle degree. From the low at 1.522, where wave a completed, the corrective wave b began. Wave b of the cycle degree is anticipated to form a corrective pattern. Price has already finished primary degree waves A and B (circled) of c in June and August 2024, respectively. From the August low, primary degree wave C (circled) of b has developed into an impulsive structure. According to projections, wave C (circled) could extend up to 3.53 and possibly reach as high as 4.17. This offers potential for short-term traders to continue buying pullbacks on the hourly charts.

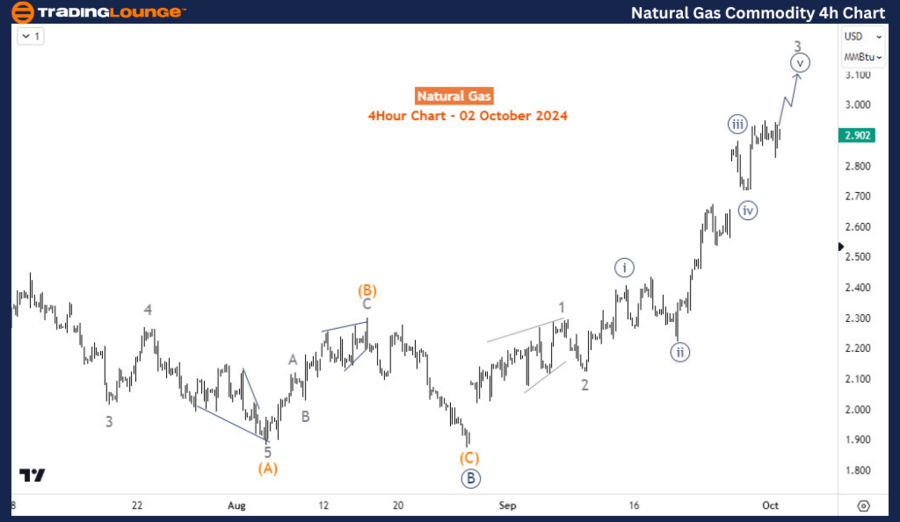

Natural Gas Commodity Elliott Wave - 4-Hour Chart Analysis

The H4 chart outlines the sub-waves of wave C (circled) and illustrates the progress made so far. Currently, the price is in wave 5 of (3) of C (circled). The next anticipated pullback, wave (4), if corrective, may present another buying opportunity from the dip.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Iron Ore Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support