CRM Elliott Wave Analysis for Salesforce Inc. (CRM)

This analysis delves into the current trend structure of Salesforce Inc. (CRM) by applying the Elliott Wave Theory across both daily and 1-hour charts. Below is an overview of the stock's current position and its potential future trajectory.

CRM Elliott Wave Analysis - TradingLounge Daily Chart

Salesforce Inc. (CRM) Daily Chart Overview

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 3

Direction: Upside within 3

Details: As the correction in Primary wave 4 might still be incomplete, the possibility of a running flat in wave 4 is being considered. This suggests that Salesforce could be in the early stages of a potential bull market.

CRM Daily Chart Analysis: CRM Elliott Wave Outlook

On the daily chart, Salesforce (CRM) is currently in the third wave (Minor wave 3) of an impulsive structure. Analysts are evaluating whether a Primary wave 4 correction is still unfolding. This points toward a potential running flat correction in wave 4, indicating that CRM might be in the early stages of a new bull market. If this scenario holds true, the stock could see higher trends once the correction phase is completed.

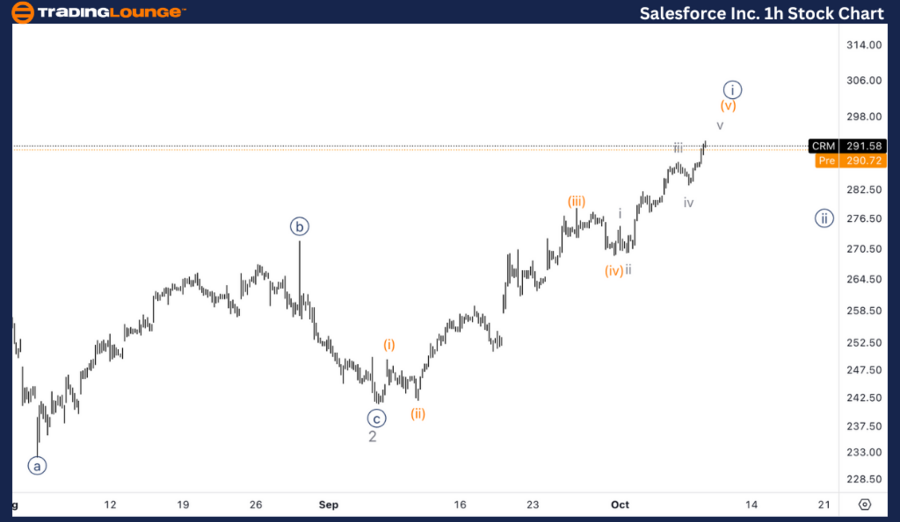

Salesforce Inc Elliott Wave Analysis - TradingLounge 1-Hour Chart

Salesforce Inc. (CRM) 1-Hour Chart Overview

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Top in wave {i}

Details: A top in wave {i} of 3 could soon form, as a well-defined subdivision is visible. However, it's possible that this move is part of wave C, and the broader correction may still continue.

1-Hour Chart Analysis: CRM Elliott Wave Outlook

On the 1-hour chart, Salesforce is approaching a potential top in wave {i} of 3, with clear subdivisions evident in the wave structure. Alternatively, this movement could belong to wave C, suggesting that the larger corrective phase may not be over yet. How this current wave develops will determine whether the correction has ended or if further downside is anticipated before the stock resumes its upward trend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Coca-Cola Company (KO) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support