DAX 40 (Germany) Elliott Wave Analysis Trading Lounge Day Chart

DAX (Germany) India Daily Chart Analysis

DAX 40 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

DIRECTION NEXT LOWER DEGREES: Gray Wave 4

DETAILS: Gray Wave 2 appears complete. Currently, Gray Wave 3 of Orange Wave 3 is in progress.

Wave Cancel Invalid Level: 18,182.52

The DAX (Germany) daily chart indicates a bullish trend forming within an impulsive wave structure. The market is currently in Gray Wave 3, positioned inside Orange Wave 3, pointing towards strong upward momentum.

With Gray Wave 2 completed, the market is unfolding Gray Wave 3 within Orange Wave 3, fueling the ongoing bullish trend. Impulsive wave structures often signal robust market trends, and Gray Wave 3 typically represents a powerful phase within the Elliott Wave cycle.

The next lower-degree wave, Gray Wave 4, is anticipated once the current wave concludes. However, the market remains focused on Gray Wave 3, continuing its upward trajectory within this bullish framework.

The wave cancellation level is set at 18,182.52. A fall below this threshold would invalidate the current Elliott Wave count, potentially marking the end of the current upward movement or the beginning of a new wave pattern.

Summary:

- Bullish Trend: Active Gray Wave 3 of Orange Wave 3 unfolding.

- Gray Wave 2 completed, indicating further upward progress.

- As long as the price remains above 18,182.52, the bullish trend should continue.

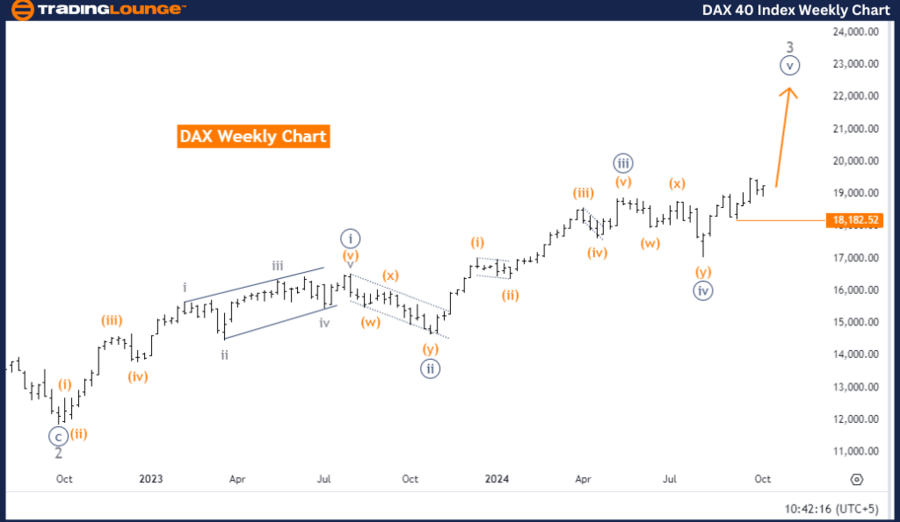

DAX 40 (Germany) Elliott Wave Analysis Trading Lounge Weekly Chart

DAX (Germany) Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 5

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Gray Wave 4

DETAILS: Navy Blue Wave 4 appears complete. Currently, Navy Blue Wave 5 is in progress.

Wave Cancel Invalid Level: 18,182.52

The weekly chart of the DAX (Germany) signals a bullish trend within an impulsive wave structure. The current wave position is Navy Blue Wave 5, with the market in Gray Wave 3, indicating ongoing upward movement.

With Navy Blue Wave 4 concluded, the market is now progressing through Navy Blue Wave 5, suggesting that the market is entering the final stage of the Elliott Wave cycle for this higher degree. The impulsive nature of Navy Blue Wave 5 is driving the bullish trend further.

The next lower-degree wave, Gray Wave 4, will follow after Gray Wave 3 completes. Currently, Gray Wave 3 is driving the market upwards, maintaining the bullish momentum.

The wave cancellation level remains at 18,182.52. A drop below this level would invalidate the current Elliott Wave count, signaling either the end of the bullish trend or the onset of a corrective phase.

Summary:

- Bullish Trend: Navy Blue Wave 5 in progress after Navy Blue Wave 4 completion.

- Gray Wave 3 is driving prices upward, with potential continuation as long as the price remains above 18,182.52.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TASI Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support