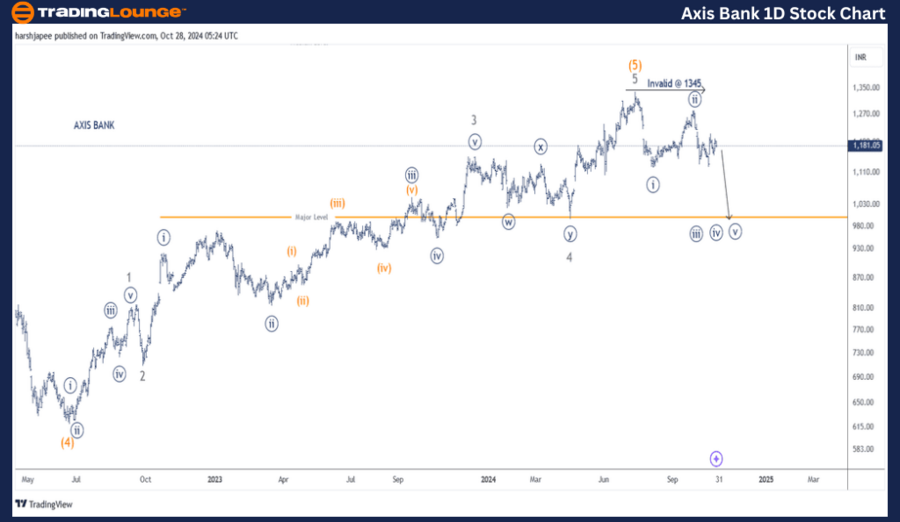

AXIS BANK LTD – AXISBANK Elliott Wave Analysis (1D Chart)

AXISBANK Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey. Wave A unfolding)

Mode: Corrective

Structure: Potential Impulse

Position: Minute Wave ((ii)) Navy of 1/A complete.

Details: Minute Wave ((iii)) Navy appears to be moving towards the 1000 level, as long as resistance around 1345 holds. A minor pullback is currently unfolding, signaling that bearish momentum may soon resume.

Invalidation point: 1340-50.

AXIS Bank Daily Chart Analysis: Elliott Wave Counts and Projections

The daily chart for AXIS Bank suggests a completed rally around 1345, marking the termination of Intermediate Wave (5) in Orange. Following this high, the stock appears to be trending lower as Minute Waves ((i)) and ((ii)) seem complete, with Minute Wave ((iii)) in progress, aiming toward the 1000 mark.

Earlier, Intermediate Wave (4) Orange ended around the 620 level in January 2022. From there, Minor Waves 1 through 5 advanced, reaching a peak at 1345. Minor Wave 3 extended near 1155, followed by Minor Wave 4, which ended around 995 in a combination pattern.

A countertrend move at the Minute degree may be developing against the 1345 high, with Minute Wave ((iii)) potentially unfolding at present.

AXIS BANK LTD – AXISBANK Elliott Wave Analysis (4H Chart)

Function: Counter Trend (Minor degree, Grey. Wave A unfolding)

Mode: Corrective

Structure: Potential Impulse

Position: Minute Wave ((ii)) Navy of 1/A complete.

Details: The 4H chart signals that Minute Wave ((iii)) Navy is moving toward 1000, with resistance near the 1345 level. A minor pullback could occur before the next bearish leg resumes.

Invalidation point: 1340-50.

AXIS Bank 4H Chart Analysis: Elliott Wave Insights

The 4H chart for AXIS Bank underscores developments from Minor Wave 3 in Grey onward. Wave 4 appeared as a combination pattern, while Wave 5 surged up to the 1345 high. The lower degree impulse, Minute Wave ((i)), seems to have completed near the 1128 low, followed by a corrective rise in Minute Wave ((ii)) around the 1290 level. Current indications suggest bears are likely to maintain control as Minute Wave ((iii)) progresses.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI Green Energy Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

AXIS Bank’s Minute Wave ((iii)) appears poised to trend lower towards the 1000 level, provided prices stay beneath the resistance near 1345.