GX Uranium ETF Commodity Elliott Wave Technical Analysis

GX Uranium ETF Elliott Wave Analysis

The Global X Uranium ETF (GX URA) offers investors exposure to the uranium sector, focusing on companies involved in uranium mining, exploration, and production worldwide. As nuclear energy gains momentum as a cleaner power source, the demand for uranium may increase, making the GX URA ETF an attractive option for investors looking to capitalize on the sector's growth potential.

Long-Term Elliott Wave Analysis

Analyzing the GX URA ETF from an Elliott Wave perspective reveals a sustained bullish correction following a significant downtrend. Between February 2011 and March 2020, the ETF's price consistently declined, establishing lower lows and lower highs in line with an extended impulse wave pattern. This prolonged downtrend ended in March 2020, with a recovery sequence beginning shortly after.

GX Uranium ETF Commodity Daily Chart Analysis

After this low, the ETF completed an impulsive wave A (circled) of the primary degree by November 2021, initiating the first phase of a larger corrective pattern. Subsequently, a corrective pullback emerged as wave B (circled), which concluded in July 2022. From this point, an impulsive structure shaped wave (1) of C (circled), peaking in May 2024. A pullback then formed as wave (2) on the daily chart, leading to a rally starting on August 5, 2024. This rally likely represents the initial development of wave 1 of (3), marking the next phase of the bullish recovery. As wave 1 is still forming, the ETF holds substantial upside potential within this corrective structure.

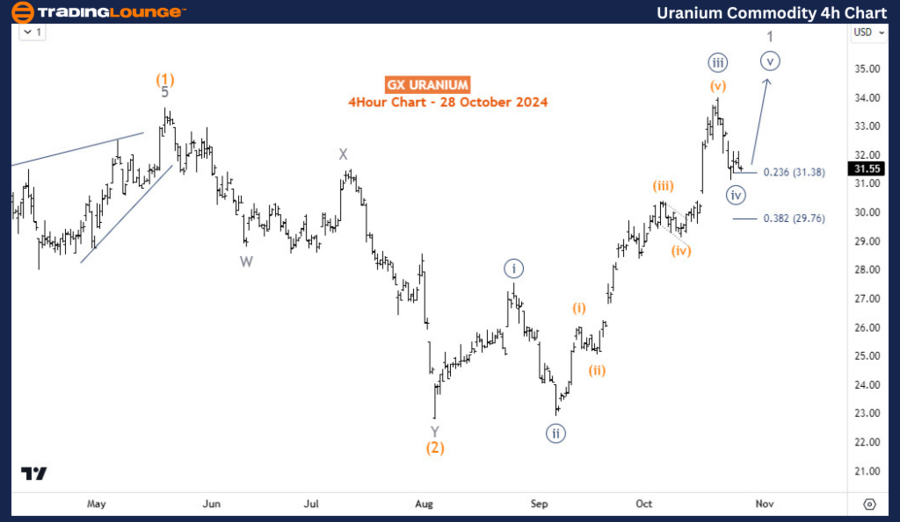

GX Uranium ETF Commodity H4 Chart Analysis

Zooming in on the H4 timeframe, the impulsive recovery beginning August 5th broke above the high of wave (1), confirming that wave (3) has commenced following the completion of wave (2) at August's low. This surge aligns with wave 1 of (3) as projected, though wave 1 remains ongoing. Last week's pullback suggests the ETF is presently in wave ((iv)) of 1, hinting at one final upward push in wave ((v)) of 1 before a more considerable pullback unfolds in wave 2. This expected move presents attractive opportunities for investors as the long-term bullish correction progresses.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support