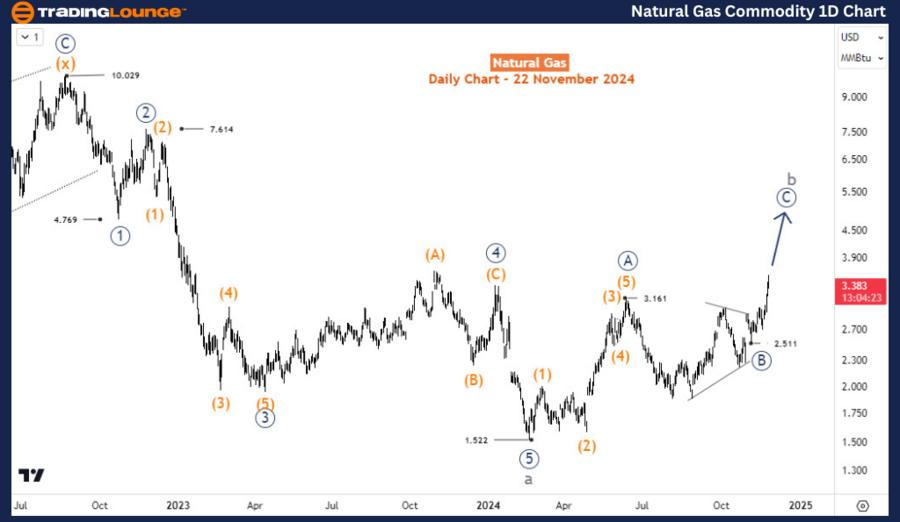

Natural Gas Elliott Wave Technical Analysis

Natural Gas broke higher this week, surpassing the previous high set on June 11. The commodity has surged over 120% since its February 2024 low and has now recovered nearly half of the steep sell-off that occurred between August 2022 and February 2024.

Natural Gas Daily Chart Analysis

On the daily chart, the recovery from the February 21 low of 1.522 is acting as a correction to the entire 5-wave decline seen from August 22, when prices were at $10, to February 21, when prices dropped to nearly $1.5. Using Fibonacci projections, this recovery may extend into the $3.9–$5 range.

Natural Gas H4 Chart Analysis

On the H4 chart, wave (1) of ((C)) is unfolding and appears to remain incomplete.

Investors should monitor these levels closely as the Elliott Wave pattern continues to evolve, offering potential trading setups based on corrections and rallies.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support