USDCAD Elliott Wave Analysis: Trading Lounge Day Chart

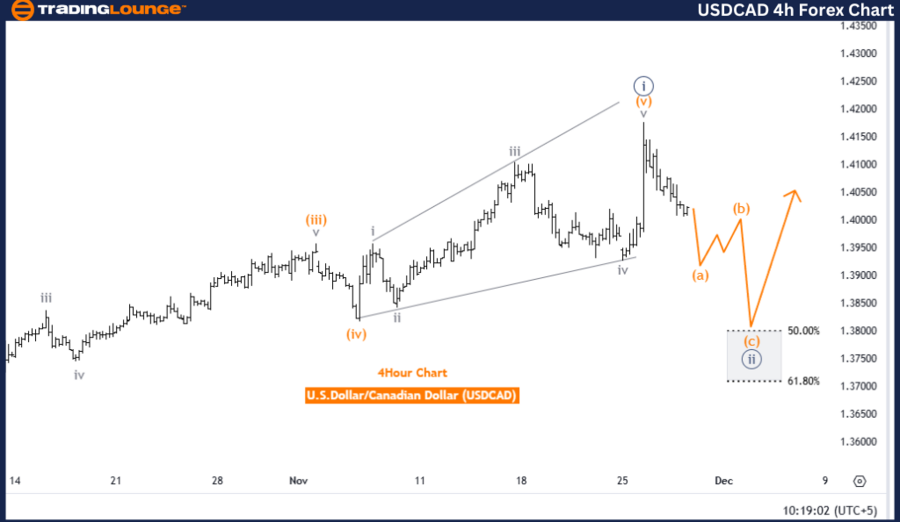

U.S. Dollar/Canadian Dollar (USDCAD) Day Chart Analysis

USDCAD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3

Details: Navy blue wave 1 is completed, and navy blue wave 2 is currently developing.

Wave Cancel Invalidation Level: 1.34201

The analysis utilizes Elliott Wave Theory to examine the USD/CAD pair on a daily chart, currently in a counter-trend phase. The corrective mode reflects a temporary pullback within the broader trend.

The primary structure under analysis is navy blue wave 2, which follows the completed navy blue wave 1. This signals an ongoing correction phase before the anticipated shift to the impulsive navy blue wave 3.

The current wave position is within gray wave 3, which is a smaller wave nested inside the corrective navy blue wave 2 structure. This ongoing correction is expected to progress before transitioning into navy blue wave 3, signaling a continuation of the broader upward impulsive trend.

Key Level for Invalidation

The invalidation level for this wave structure is set at 1.34201. A price movement reaching this level would invalidate the current wave count and corrective outlook, making it a critical reference for risk management and structural confirmation.

Summary

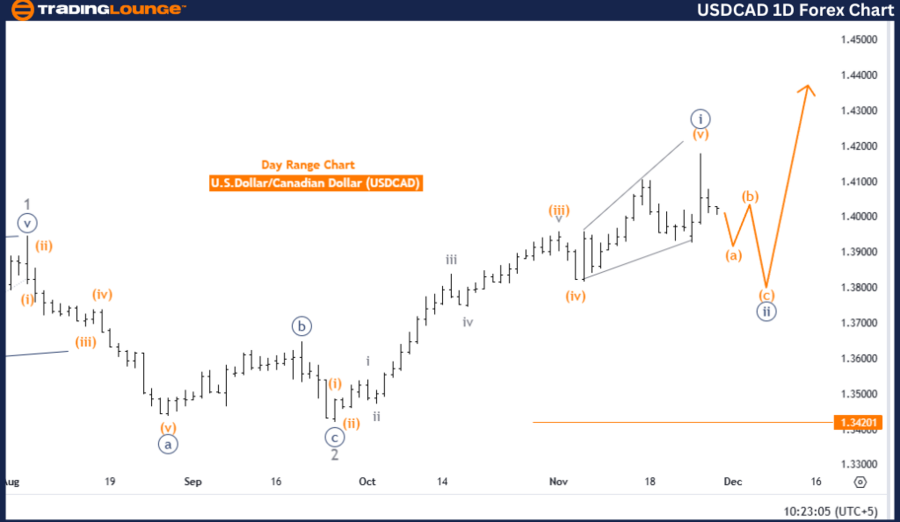

U.S. Dollar/Canadian Dollar (USDCAD) 4-Hour Chart

USDCAD Forex Pair Technical Analysis

Function: Counter Trend

Mode: Impulsive as A

Structure: Orange Wave A

Position: Navy Blue Wave 2

Direction Next Higher Degrees: Orange Wave B

Details: Navy blue wave 1 has been completed, and the orange wave A of navy blue wave 2 is currently developing.

Wave Cancel Invalidation Level: 1.34201

This analysis focuses on USD/CAD using Elliott Wave Theory on a 4-hour chart. The pair is in a counter-trend phase, specifically in the impulsive orange wave A, the first segment of a broader corrective movement.

This phase follows navy blue wave 1’s completion, marking the early stages of navy blue wave 2.

Currently, the position is within orange wave A, reflecting the initial corrective leg. This movement is expected to continue before progressing into orange wave B, which will form the next segment of this correction at a higher degree.

Key Level for Invalidation

The invalidation threshold for this wave structure is defined at 1.34201. Reaching this level would nullify the current wave count and corrective outlook, providing a vital reference point for risk management and confirmation.

Summary

- Elliott Wave Analysis indicates USDCAD in a counter-trend phase, with orange wave A actively unfolding within navy blue wave 2.

- Navy blue wave 1 completion initiated this corrective phase.

- The counter-trend perspective remains valid as long as the price stays above 1.34201.

- Further movement within orange wave A is expected, followed by the development of orange wave B, completing the corrective structure at a higher degree.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support