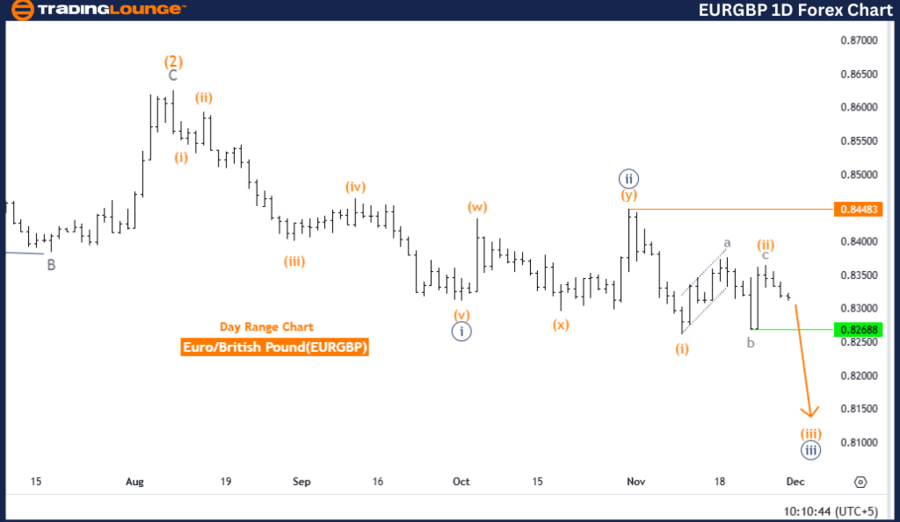

Euro/British Pound (EURGBP) Elliott Wave Analysis - Trading Lounge Day Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 3

Direction (Next Lower Degrees): Orange wave 3 (in progress)

Details

-

Orange wave 2 appears to have concluded, with orange wave 3 now in progress. This progression aligns with the continuation of the bearish trend as defined by the Elliott Wave framework.

-

Invalidation Level: 0.84483

If the price moves to this level, the current wave count and bearish forecast become invalid. This level is vital for confirming the trend and managing associated risks.

Analysis Overview

The Elliott Wave analysis for EURGBP on the daily chart underscores a dominant bearish trend. The pair is currently experiencing an impulsive phase, with orange wave 3 active following the completion of orange wave 2. This progression signals ongoing bearish momentum, suggesting further downward price movement.

The active wave position resides in navy blue wave 3, a substructure of the overarching orange wave 3. The continuation of orange wave 3 indicates sustained bearish activity, reinforcing the outlook for further declines.

- Invalidation level: The price remains under 0.84483, confirming the bearish wave count's validity. This threshold helps validate the trend and provides a framework for risk management.

Summary

The Elliott Wave analysis suggests the following:

- EURGBP is entrenched in a bearish trend.

- Orange wave 3 is active following the completion of orange wave 2.

- The bearish outlook is bolstered by the ongoing navy blue wave 3 within the larger orange wave 3 framework.

- The invalidation level of 0.84483 is pivotal for confirming or adjusting the analysis.

As orange wave 3 progresses, the bearish perspective remains dominant unless the price breaches the invalidation level.

Euro/British Pound (EURGBP) Elliott Wave Analysis - Trading Lounge 4-Hour Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 3

Direction (Next Lower Degrees): Orange wave 3 (in progress)

Details

-

Orange wave 2 appears to have completed, with orange wave 3 now developing. This confirms the continuation of bearish momentum within the Elliott Wave structure.

-

Invalidation Level: 0.84483

If the price ascends to this point, the current wave count and bearish sentiment will no longer hold. This threshold is critical for trend validation and risk management.

Analysis Overview

On the 4-hour chart, the Elliott Wave analysis highlights a bearish trend. The currency pair is in an impulsive phase, with orange wave 3 underway after the confirmed completion of orange wave 2. This phase is characterized by strong downward momentum, signaling further price declines.

The wave structure shows navy blue wave 3 as part of the broader orange wave 3 formation. As this wave develops, the pair continues to exhibit bearish pressure, maintaining the overall downward trajectory.

- Invalidation level: The price remains below 0.84483, ensuring the bearish wave count's accuracy. This level is essential for maintaining the current trend analysis and managing trading risks.

Summary

The Elliott Wave analysis provides the following insights:

- EURGBP sustains a bearish trend.

- Orange wave 3 is progressing, succeeding orange wave 2.

- Navy blue wave 3 supports the bearish outlook within the broader orange wave 3 structure.

- The invalidation level of 0.84483 serves as a key indicator for confirming or revising the wave count.

As orange wave 3 unfolds, the bearish sentiment is expected to persist, suggesting further price declines unless the price breaches the invalidation level.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCAD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support