AUDUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 15 December 23

Australian Dollar/U.S.Dollar (AUDUSD) 4 Hour Chart

AUDUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: blue wave 5 of 1

Position: Red wave 3

Direction Next Lower Degrees: black wave 2

Details: blue wave 5 of 1 is in play . Wave Cancel invalid level: 0.65406

The "AUDUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 15 December 23, provides a comprehensive analysis of the Australian Dollar/U.S. Dollar (AUDUSD) currency pair, focusing on the 4-hour timeframe and employing Elliott Wave principles for technical analysis.

The identified "Function" is "Trend," indicating that the analysis is oriented towards identifying and understanding the prevailing trend in the market. This information is crucial for traders looking to align their strategies with the dominant market direction.

The specified "Mode" is "Impulsive," signifying that the current phase is characterized by strong and directional price movements. Impulsive waves are typically associated with the main trend and can present opportunities for traders to participate in significant market moves.

The primary "Structure" involves "blue wave 5 of 1," highlighting the position of the current wave within the broader Elliott Wave framework. Understanding the structure is essential for traders to anticipate potential price movements and formulate appropriate strategies.

The described "Position" is labeled as "Red wave 3," providing information about the current wave's placement within the larger Elliott Wave structure. This context aids traders in comprehending the ongoing market dynamics and making informed decisions.

In terms of "Direction Next Lower Degrees," the projection is "black wave 2," indicating the expected corrective wave within the broader Elliott Wave structure. This information assists traders in anticipating potential future market movements in the downward direction as part of the corrective phase.

The "Details" section highlights that "blue wave 5 of 1 is in play." This suggests that the current impulsive wave is part of a broader bullish trend. Traders can use this information to align their strategies with the prevailing trend.

The "Wave Cancel invalid level" is identified as "0.65406." This level serves as a critical point at which the current wave count would be invalidated, prompting a reassessment of the prevailing market conditions.

In summary, the AUDUSD Elliott Wave Analysis for the 4-hour chart on 15 December 23, suggests an impulsive wave labeled as "blue wave 5 of 1," indicating a bullish trend. The analysis provides insights into the anticipated corrective wave, "black wave 2," and highlights a crucial invalidation level at 0.65406. Traders can utilize this information for a comprehensive understanding of market conditions and to align their strategies accordingly.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!

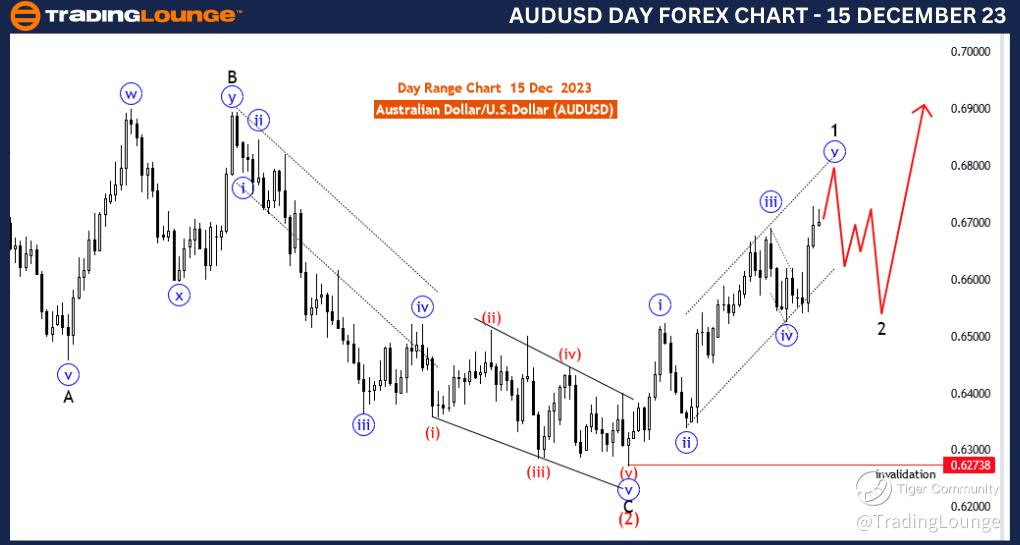

AUDUSD Elliott Wave Analysis Trading Lounge Day Chart, 15 December 23

Australian Dollar/U.S.Dollar (AUDUSD) Day Chart

AUDUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: blue wave 5 of 1

Position: Red wave 3

Direction Next Lower Degrees: black wave 2

Details: blue wave 5 of 1 is in play and expecting to go up more . Wave Cancel invalid level: 0.62738

The "AUDUSD Elliott Wave Analysis Trading Lounge Day Chart" dated 15 December 23, provides a detailed analysis of the Australian Dollar/U.S. Dollar (AUDUSD) currency pair on a daily timeframe. The analysis employs Elliott Wave principles to offer insights into the market's structure and potential future movements.

The identified "Function" is "Trend," indicating that the primary focus of the analysis is on discerning and understanding the prevailing trend in the market. This is crucial information for traders seeking to align their strategies with the dominant market direction.

The specified "Mode" is "Impulsive," suggesting that the current market phase is characterized by strong and directional price movements. Impulsive waves are typically associated with the main trend and can present opportunities for traders to participate in significant market moves.

The primary "Structure" involves "blue wave 5 of 1," providing information about the current wave's placement within the broader Elliott Wave framework. Understanding the structure is essential for traders to anticipate potential price movements and formulate appropriate strategies.

The described "Position" is labeled as "Red wave 3," indicating the current wave's position within the larger Elliott Wave structure. This context aids traders in comprehending the ongoing market dynamics and making informed decisions.

In terms of "Direction Next Lower Degrees," the projection is "black wave 2," signifying the expected corrective wave within the broader Elliott Wave structure. This information assists traders in anticipating potential future market movements in the downward direction as part of the corrective phase.

The "Details" section highlights that "blue wave 5 of 1 is in play and expecting to go up more." This suggests that the current impulsive wave is part of a broader bullish trend, and further upward movement is anticipated. Traders can use this information to align their strategies with the prevailing trend.

The "Wave Cancel invalid level" is identified as "0.62738." This level serves as a critical point at which the current wave count would be invalidated, prompting a reassessment of the prevailing market conditions.

In summary, the AUDUSD Elliott Wave Analysis for the daily chart on 15 December 23, suggests an impulsive wave labeled as "blue wave 5 of 1," indicating a bullish trend. The analysis provides insights into the anticipated corrective wave, "black wave 2," and highlights a crucial invalidation level at 0.62738. Traders can utilize this information for a comprehensive understanding of market conditions and to align their strategies accordingly.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!