The Coca-Cola Company, Elliott Wave Technical Analysis

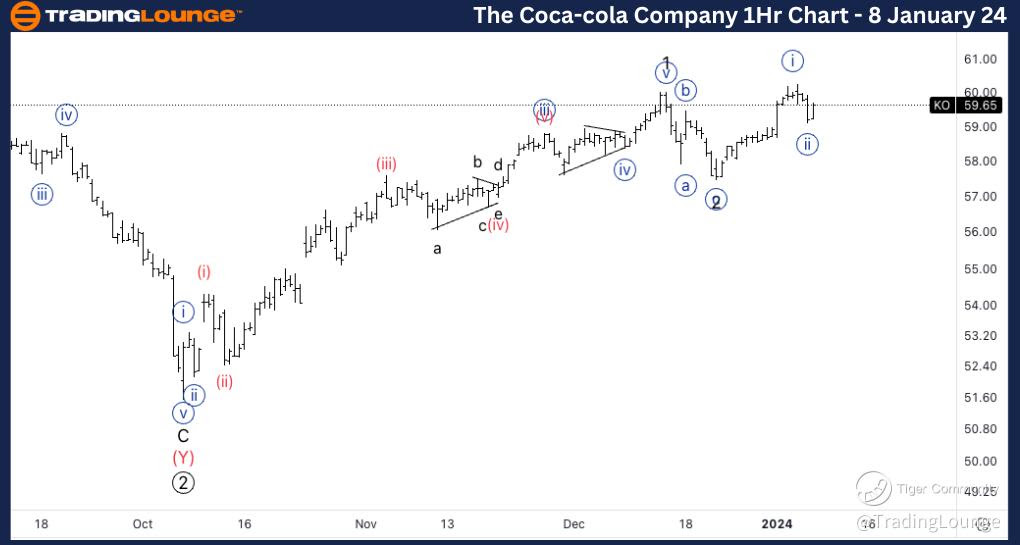

The Coca-Cola Company, (KO:NYSE): 4h Chart 8 January 24

KO Stock Market Analysis: We are looking at a potential five wave move completed into wave 1 and we are now seeing continuation higher as big tech are losing ground and momentum seems to be rotating into the consumer sector.

KO Elliott Wave Count: Wave {ii} of 3.

KO Technical Indicators: 20EMA as support.

KO Trading Strategy: Looking for longs after a Trading Level Pattern on 60$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

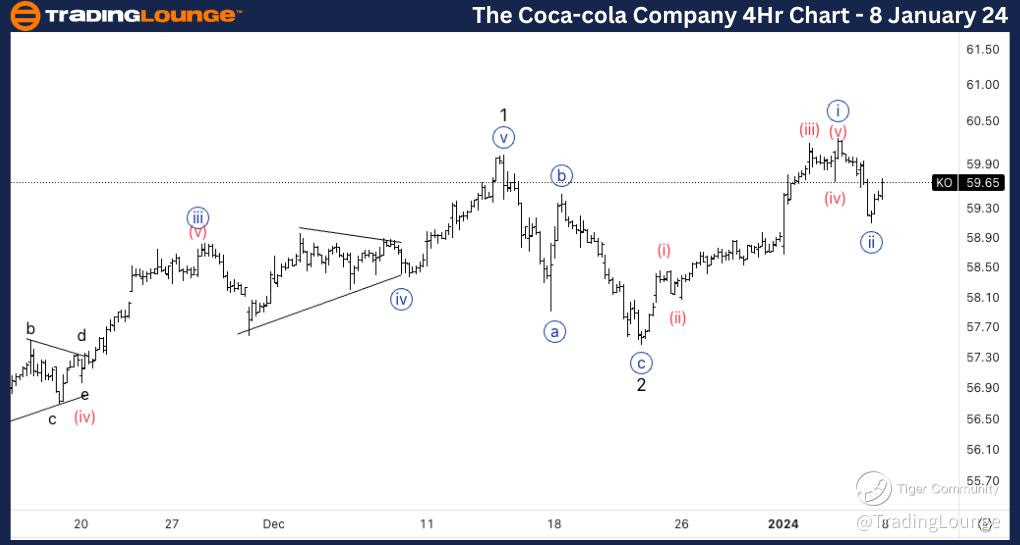

The Coca-Cola Company, KO: 1-hour Chart 8 January 24

The Coca-Cola Company, Elliott Wave Technical Analysis

KO Stock Market Analysis: Looking at what seems to be a sharp three wave move into wave {ii}, being aware we could correct lower.

KO Elliott Wave count: Wave {ii} of 3.

KO Technical Indicators: 20EMA as resistance.

KO Trading Strategy: Looking for longs after a Trading Level Pattern on 60$.