Explore the latest Elliott Wave Analysis for Binance Coin / U.S. dollar (BNBUSD) with our expert Tradinglounge analyst. Gain valuable insights into the current market trends, technical indicators, and potential trading strategies. Discover how BNBUSD is positioned within the Elliott Wave framework and learn about the exciting trading opportunities that may arise.

Elliott Wave Technical Analysis - Unraveling BNBUSD Trends

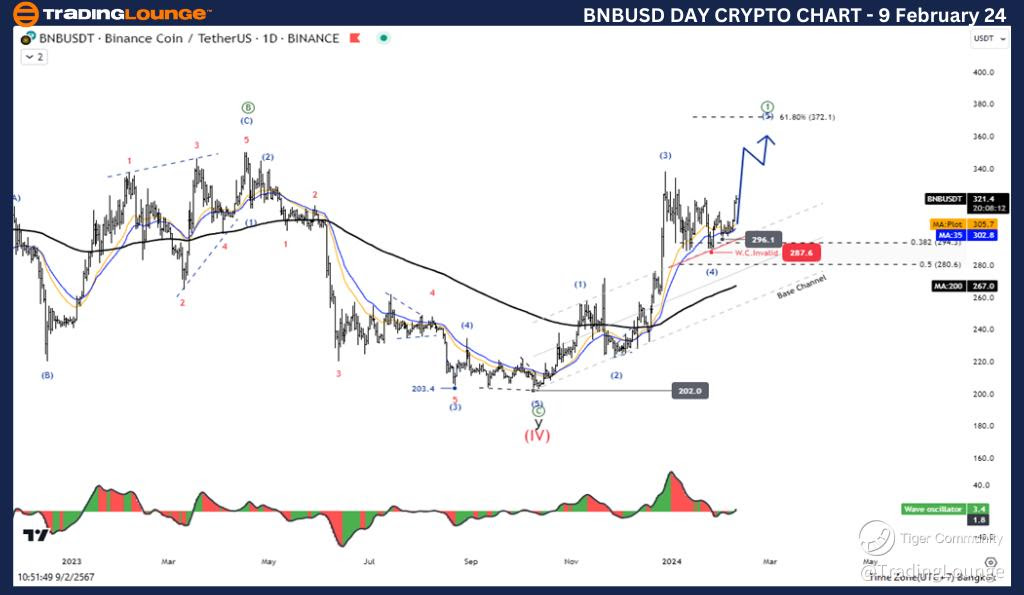

Delve into the intricacies of BNBUSD Elliott Wave Analysis as we examine its daily and 4-hour charts on February 9, 2024. Our focus lies on identifying the counter-trend, corrective structure, and potential trading strategies.

Daily Chart Analysis: Wave 4 Correction and Wave 5 Anticipation

On the daily chart, BNBUSD is currently exhibiting a counter-trend movement in the form of a corrective zigzag structure. Positioned at Wave 4, the ongoing correction may have reached completion, paving the way for an imminent price surge in Wave 5.

Key Insights:

- Function: Counter Trend

- Mode: Corrective

- Structure: Zigzag

- Position: Wave 4

- Direction Next higher Degrees: Wave ((1)) of Impulse

- Wave Cancel invalid level: 202.8

Trading Strategy: Anticipate another upward move in Wave (5) post the conclusion of Wave (4). A price target of 372.1 is envisioned, aligning with the 0.618 Fibonacci retracement level of the length between Wave (1) and Wave (3). This projection signals the continuation of Binance's uptrend, suggesting further potential for price escalation.

Technical Indicators: The daily chart reflects a strong uptrend, with the price comfortably positioned above the MA200, indicating a bullish momentum. Wave oscillators further confirm the positive outlook for BNBUSD, supporting the likelihood of an upward price trajectory.

4-Hour Chart Analysis: Confirming the Wave 4 Correction

Zooming into the 4-hour chart provides a closer look at the ongoing corrective Wave 4. As mentioned earlier, the correction appears to be concluding, setting the stage for a subsequent surge in Wave 5.

Key Insights:

- Function: Counter Trend

- Mode: Corrective

- Structure: Zigzag

- Position: Wave 4

- Direction Next higher Degrees: Wave ((1)) of Impulse

- Wave Cancel invalid level: 202.8

Trading Strategy: Reiterate the expectation for a rise in Wave (5) post Wave (4) completion. The 372.1 price target remains intact, aligning with the 0.618 Fibonacci retracement level. This reinforces the overall bullish sentiment surrounding BNBUSD, suggesting potential gains shortly.

Technical Indicators: Consistency prevails on the 4-hour chart, with the price comfortably above the MA200, affirming the prevailing uptrend. Wave oscillators maintain a bullish momentum, providing additional confirmation of the positive outlook for Binance Coin.

Analyst Insights: Provided by Kittiampon Somboonsod, CEWA, from TradingLounge.

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: AAVE / U.S. dollar(AAVEUSD)