Gold Elliott Wave Technical Analysis - 20 February 24

Gold Elliott Wave Analysis

Gold (XAUUSD) Daily Time Frame

On the daily time frame, the current Elliott Wave analysis for gold suggests that we are witnessing what could be a zigzag pattern - blue wave Y after blue wave X completed with a triangle pattern at 2044. In a larger scope, we are observing the development of Blue Wave Y into a probable zigzag within the context of a larger Red Wave IV of a diagonal.

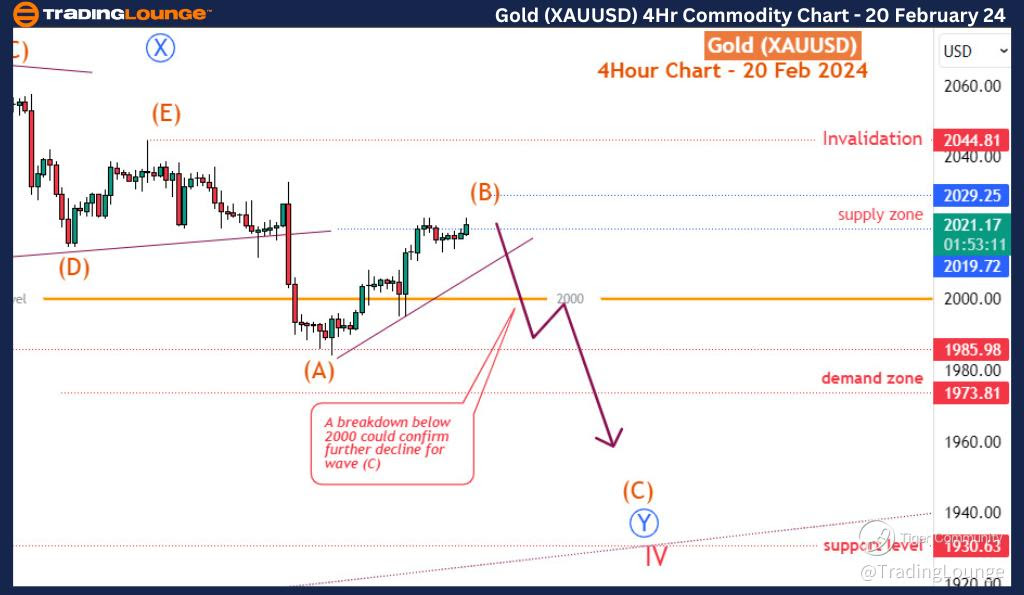

Gold (XAUUSD) 4-hour Time Frame

On the 4-hour time frame, blue Wave Y is still unfolding, with recent price action indicating a continuation of this wave. Notably, Wave (E) of the triangle within Blue Wave X concluded around the $2044 mark. Following this, there was a breakdown below the low of Wave (D) which stood at $2014, signaling the initiation of Blue Wave Y.

Currently, our attention is focused on the progression of Red Wave (A)-(B)-(C) which are sub-waves of blue Y. This phase appears to be unfolding as a three-wave zigzag pattern, with the wave (B) ascending into the 2019-2029 supply zone. It's important to note that the structure's invalidation level lies at $2044.8 where blue wave X terminated. Therefore, maintaining vigilance around this level is crucial as a breach could signify a shift in the expected wave count.

However, the preferred count suggests that should the bears regain control within the aforementioned supply zone, resulting in a sharp decline below $2000 (a major level), the probability of Red Wave (C) coming into play increases significantly. In such a scenario, prices could potentially dip below the 1985-1973 demand zone, indicating a deeper correction.

In summary, the Elliott Wave analysis for gold indicates that we are currently witnessing a corrective phase within the broader context of Red Wave IV. While Blue Wave Y is still in progress, attention is focused on its sub-waves of Y i.e red wave (A)-(B)-(C), with Wave (B) currently ascending into a key zone. However, traders and analysts must remain vigilant, as a breach of key levels could lead to a reassessment of the wave count and potential shifts in market dynamics.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SoyBean