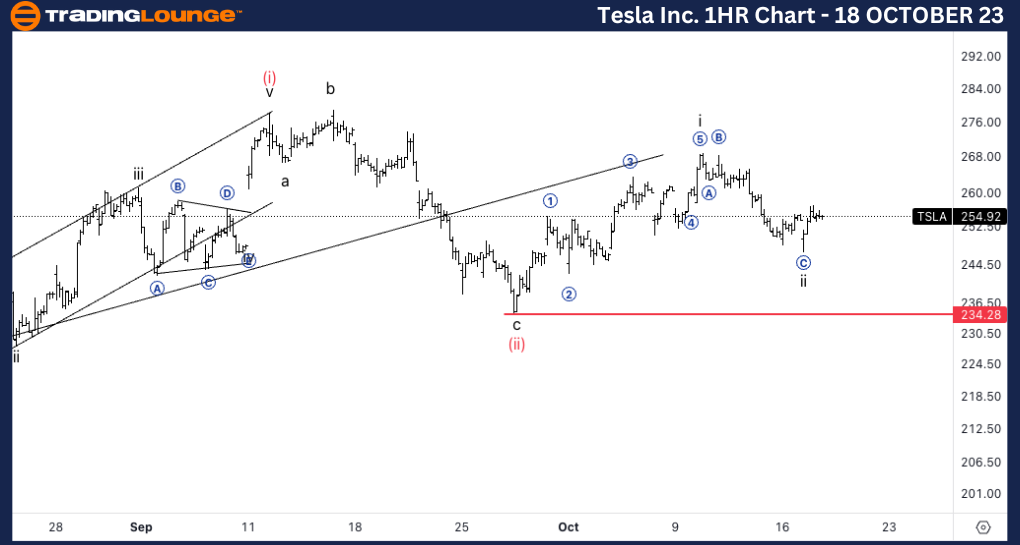

Tesla Inc., (TSLA:NASDAQ): 4H Chart, 18 October 23

Tesla Inc., Elliott Wave Technical Analysis

TSLA Stock Market Analysis: We have been looking for a series of ones and two to then accelerate to the upside. The alternate count consists of a sideways wave 4 to pair up with wave 2 and invalidation would stand south of 205$. At this point we are looking for a bottom in wave ii with invalidation at 234$.

TSLA Elliott Wave Count: Wave {iii} of 3.

TSLA Technical Indicators: 20EMA as support.

TSLA Trading Strategy: Looking for upside into wave iii of (iii) to start moving soon.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

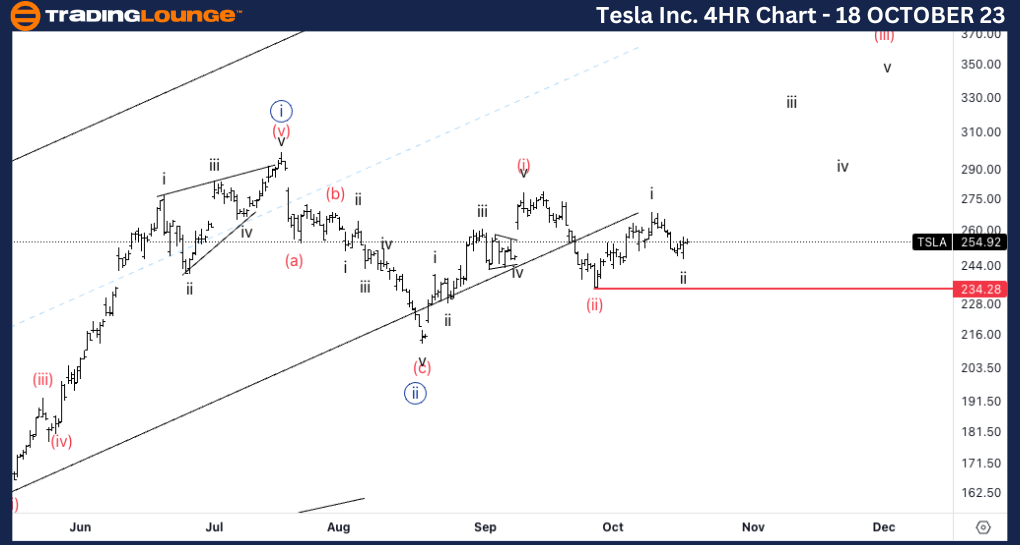

Tesla Inc., TSLA: 1-hour Chart, 18 October 23

Tesla Inc., Elliott Wave Technical Analysis

TSLA Stock Market Analysis: We are looking at a potential bottom in wave ii. It is worth noticing that the subwave structure of wave (ii) with a short wave a and a clear five wave move in c looks the same as the subwave structure of wave ii.

TSLA Elliott Wave count: Wave ii of (iii).

TSLA Technical Indicators: 200EMA as support.

TSLA Trading Strategy: Looking for upside into wave iii.