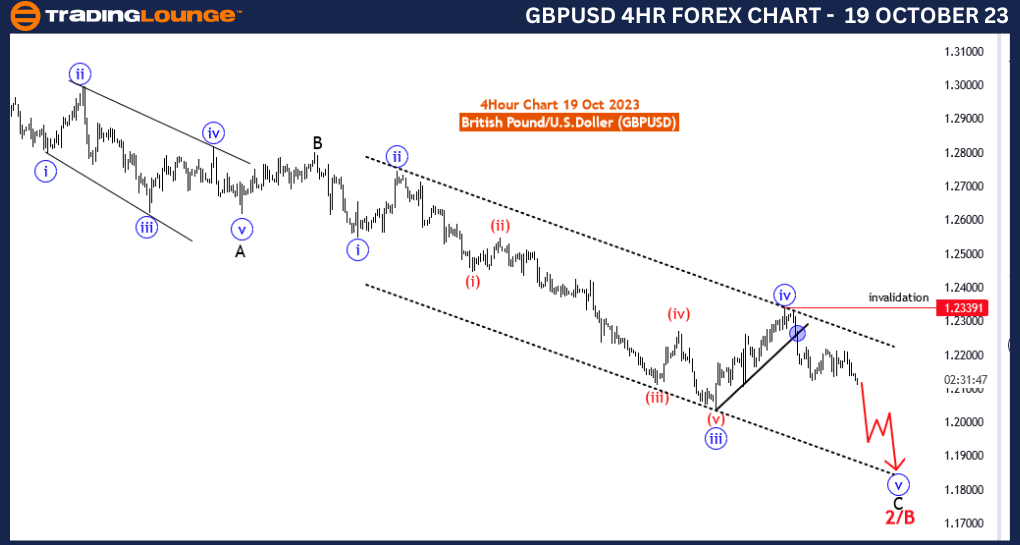

GBPUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 19 October 23

British Pound/U.S.Dollar (GBPUSD) 4 Hour Chart

GBPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: impulsive

Structure: wave 5 of C

Position: 2/B

Direction; Next Higher Degrees: wave 3/C

Details: blue wave 4 of black wave C completed at 1.23374. Now wave 5 of C is in play. Wave Cancel invalid level: 1.23391

The GBPUSD Elliott Wave Analysis for the 4-hour chart dated 19 October 23, provides a comprehensive overview of the British Pound/US Dollar (GBPUSD) currency pair's market dynamics. This analysis is a valuable resource for traders and investors seeking insights into market trends and price movements, enabling them to make informed trading decisions.

The analysis categorizes the market function as a counter-trend, indicating that it is currently moving against the primary trend. This can provide potential trading opportunities, especially for traders looking to capitalize on price corrections within the broader trend.

Furthermore, it identifies the mode as impulsive, signifying that the counter-trend movement is unfolding in a strong and decisive manner. Impulsive modes can often lead to significant price changes, making them attractive to traders who want to take advantage of short- to medium-term trends.

The main focus of this analysis is on "wave 5 of C," which denotes a specific phase within the overall market structure. According to Elliott Wave theory, wave 5 typically represents the final phase of a price movement within a broader wave structure. It is characterized by strong momentum and can be a potential trading opportunity.

The analysis highlights that "blue wave 4 of black wave C completed at 1.23374." This suggests that a corrective phase (wave 4) has concluded, and the market is now transitioning to the next phase, "wave 5 of C." Corrective phases can often be complex and challenging for traders, so the completion of wave 4 is a significant development.

"Wave Cancel invalid level: 1.23391" is a critical reference point in the analysis. This level is essential for traders to manage risk and make well-informed trading decisions. It

serves as a guide for determining when a wave structure is invalidated, signaling that the market dynamics have changed.

In summary, the GBPUSD Elliott Wave Analysis for 19 October 23, provides a valuable perspective on the GBPUSD currency pair. It identifies the current phase, wave 5 of C, following the completion of wave 4. Traders are advised to closely monitor the market for potential trading opportunities as wave 5 unfolds and to be aware of the specified invalidation level for risk management.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!

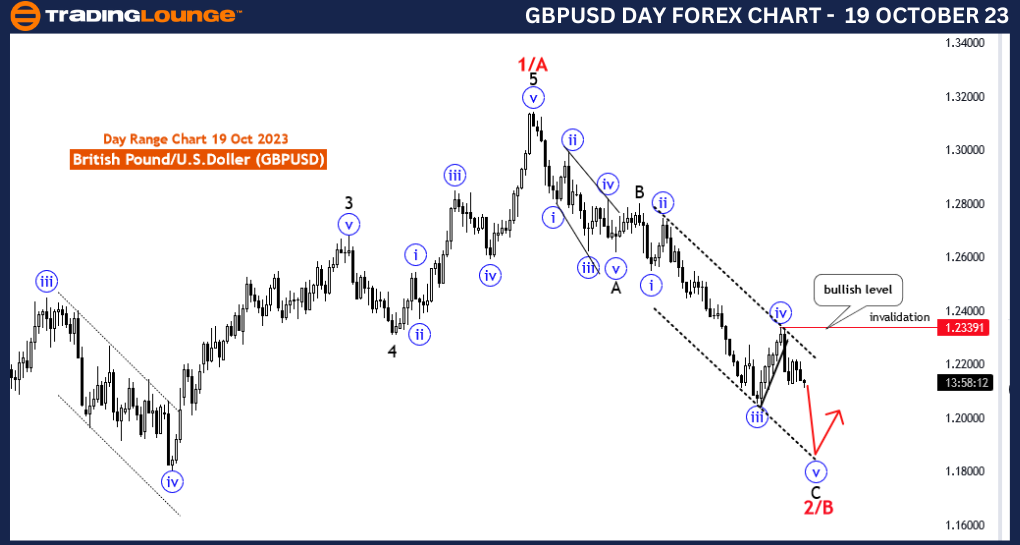

GBPUSD Elliott Wave Analysis Trading Lounge Day Chart, 19 October 23

British Pound/U.S.Dollar (GBPUSD) Day Chart

GBPUSD Elliott Wave Technical Analysis

Function:Counter Trend

Mode: impulsive

Structure: wave 5 of C

Position: 2/B

Direction;Next Higher Degrees: wave 3/C

Details: blue wave 4 of black wave C completed at 1.23374. Now wave 5 of C is in play . Wave Cancel invalid level: 1.23391

The GBPUSD Elliott Wave Analysis for the day chart on 19 October 23, provides a detailed insight into the dynamics of the British Pound/US Dollar (GBPUSD) currency pair, which can be invaluable for traders and investors looking to understand market trends and price movements.

The analysis classifies the market function as "Counter Trend," indicating that the current price movement opposes the primary trend. This insight is essential for traders who seek opportunities to capitalize on potential price reversals within the broader trend.

The "impulsive" mode classification suggests that the counter-trend movement is unfolding with a strong, decisive force. Impulsive movements often lead to significant price changes, which can be attractive for traders focusing on short- to medium-term trading opportunities.

The primary focus of this analysis is on "wave 5 of C," which denotes a specific phase within the broader market structure. According to Elliott Wave theory, wave 5 typically represents the final phase of a price movement within a broader wave structure. It is characterized by strong momentum and can provide a potential trading opportunity.

The analysis points out that "blue wave 4 of black wave C completed at 1.23374," signaling the end of a corrective phase (wave 4) and the initiation of "wave 5 of C." Corrective phases can often be challenging to navigate, making the completion of wave 4 an essential milestone for traders.

The "Wave Cancel invalid level: 1.23391" is a critical reference point within the analysis. This level serves as a guide for risk management and helps traders determine when the specified wave structure is invalidated, indicating a shift in market dynamics.

In summary, the GBPUSD Elliott Wave Analysis for 19 October 23, delivers valuable insights into the GBPUSD currency pair. It highlights the current phase, "wave 5 of C," after the completion of wave 4. Traders should closely monitor the market for potential trading opportunities as wave 5 unfolds and remain vigilant regarding the provided invalidation level for effective risk management.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!