Apple Inc. (AAPL) Elliott Wave Analysis: A Comprehensive Insight for Stock Traders

In the world of trading, understanding the underlying trends and patterns can be the key to unlocking significant opportunities. This is particularly true for stocks like Apple Inc. (AAPL), where movements can often predict broader market trends. Today, we delve into the Elliott Wave analysis of AAPL, examining its current trajectory and potential future movements.

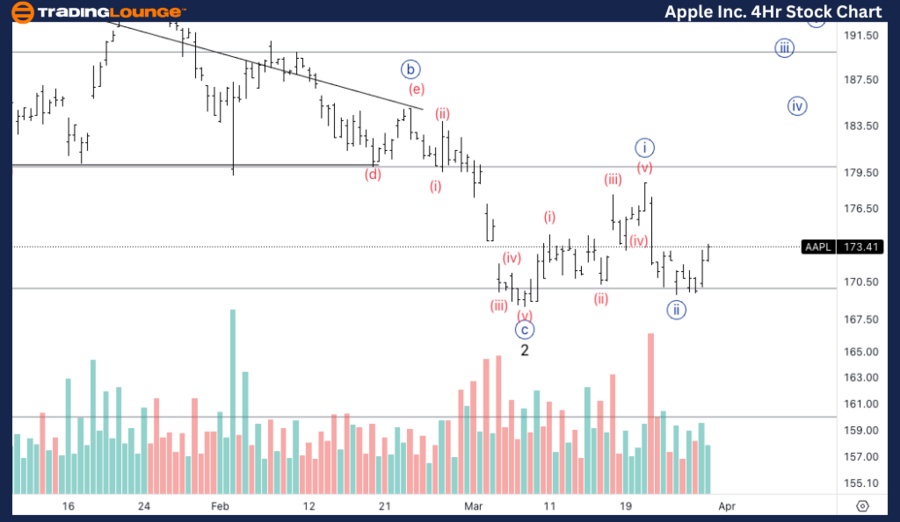

Apple Inc., (AAPL) Daily Chart Analysis

AAPL Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (5)

DIRECTION: Upside in wave 3 of (5).

DETAILS: We are looking at Apple being in a larger correction, differentiating from the rest of the major SPX components. We are exploring the possibility of a triangle in wave {b} of 2 or else we could also be in some sort of complex correction swill in wave 2.

Navigating the Corrections: Anticipating AAPL’s Next Moves

The analysis reveals Apple's current status within a larger correction phase, possibly forming a triangle in wave {b} of 2 or embarking on a complex correction within wave 2. These patterns suggest a strategic point for traders, as understanding these corrections can offer insights into future price movements and optimal entry or exit points.

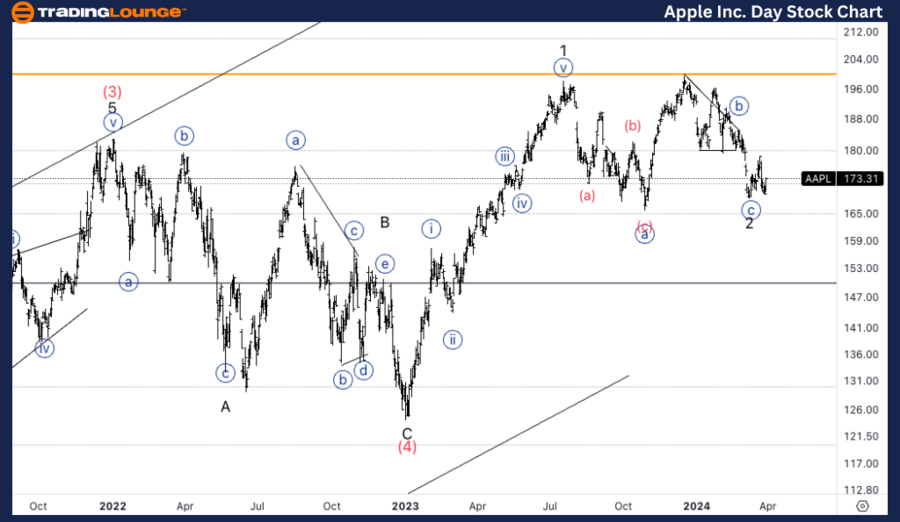

Apple Inc. (AAPL) 4-Hour Elliott Wave Insight

Apple Inc., (AAPL) 4H Chart Analysis

AAPL Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iii} of 3.

DIRECTION: Upside in wave {iii}.

DETAILS: Here we explore the possibility of further upside into wave {iii} as there is a possibility for a five-wave move into wave {i} and we are finding support in the middle of MG2 at 172$. Looking for a continuation to give us additional confirmation..

The Path Ahead: Strategic Insights for Traders

For traders and investors focusing on Apple Inc., the current Elliott Wave analysis provides a beacon for navigating the stock's future movements. The anticipation of a continued rise in wave {iii} suggests a strategic moment to consider bolstering positions in AAPL, with an eye on subsequent waves for further confirmation and insights.

Conclusion: Leveraging Elliott Wave Analysis for AAPL Trading Strategies

The intricate dance of AAPL's price movements, as deciphered through Elliott Wave analysis, offers a strategic vista for traders. By understanding the current impulsive wave, its positioning, and the potential corrections at play, traders can refine their strategies for AAPL. As always, the nuanced interpretation of these patterns, combined with a keen observation of market dynamics, will be crucial for navigating the opportunities and challenges in trading AAPL.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Walt Disney Company, (DIS)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.