Welcome to our latest Elliott Wave analysis for Exxon Mobil Inc. (XOM) as of June 10, 2024. This comprehensive analysis delves into XOM's price movements using Elliott Wave Theory, guiding traders in identifying potential opportunities based on current trends and market structure. We will provide insights from both the daily and 4-hour charts to offer a thorough perspective on XOM's market behaviour.

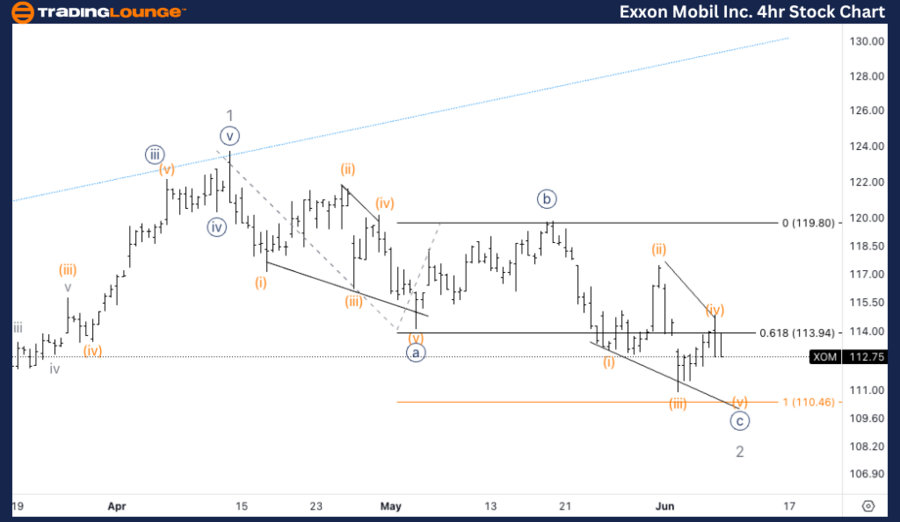

XOM Elliott Wave Analysis - Trading Lounge Daily Chart

Exxon Mobil Inc. Stock Daily Chart Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave 2

DIRECTION: Bottom in Wave 2

DETAILS: Anticipating a pullback in minor wave 2 of (5), with the possibility that wave (5) has already topped.

XOM Elliott Wave Technical Analysis

In our Elliott Wave analysis of Exxon Mobil Inc. (XOM), we identify a counter-trend corrective pattern marked by a Zigzag structure. XOM is currently in Wave 2, indicating a bottom in this corrective phase. We expect a pullback in minor wave 2 of (5), suggesting wave (5) may have already peaked. Traders should watch for signs of a completed correction and the beginning of a new upward move. The key support level of around $110 will be crucial for confirming the end of this corrective wave and the resumption of the primary trend.

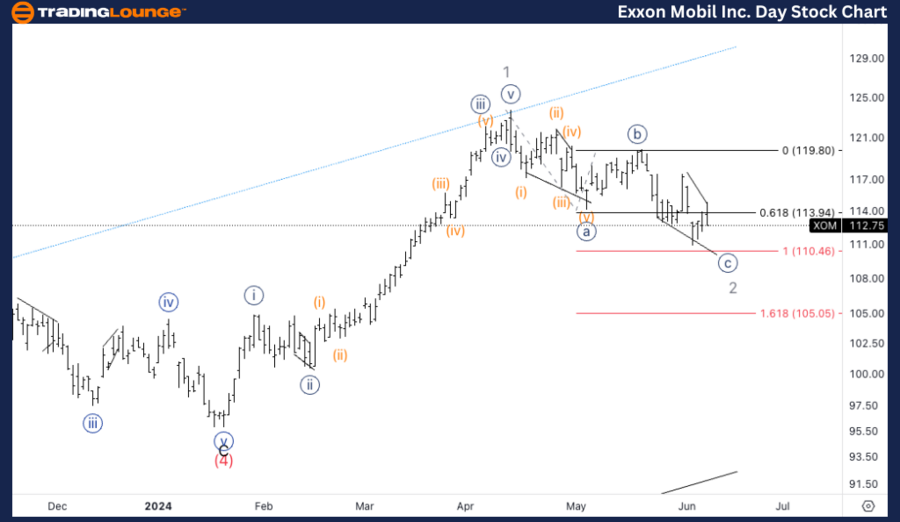

XOM Elliott Wave Analysis - Trading Lounge 4Hr Chart

Exxon Mobil Inc. (XOM) 4Hr Chart Analysis

Technical Elliott Wave Analysis of XOM Stock

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave {c} of 2

DIRECTION: Downside in Wave {c}

DETAILS: Zooming into wave 2, we observe a potential rare event with both a leading diagonal in wave {a} and an ending diagonal in wave {c}. We anticipate a bounce at the equality of {c} vs. {a} around $110.

Elliott Wave Analysis of XOM

On the 4-hour chart, XOM shows a counter-trend corrective mode within a Zigzag structure, specifically in wave {c} of 2. The analysis reveals that wave 2 features a rare scenario with both a leading diagonal in wave {a} and an ending diagonal in wave {c}. We expect a bounce at the equality of {c} vs. {a} around the $110 level. If this level holds, it could indicate the completion of wave {c} and the end of the corrective phase, offering a potential entry point for traders aiming to capitalize on a bullish reversal.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JPMorgan Chase & Co. (JPM) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support