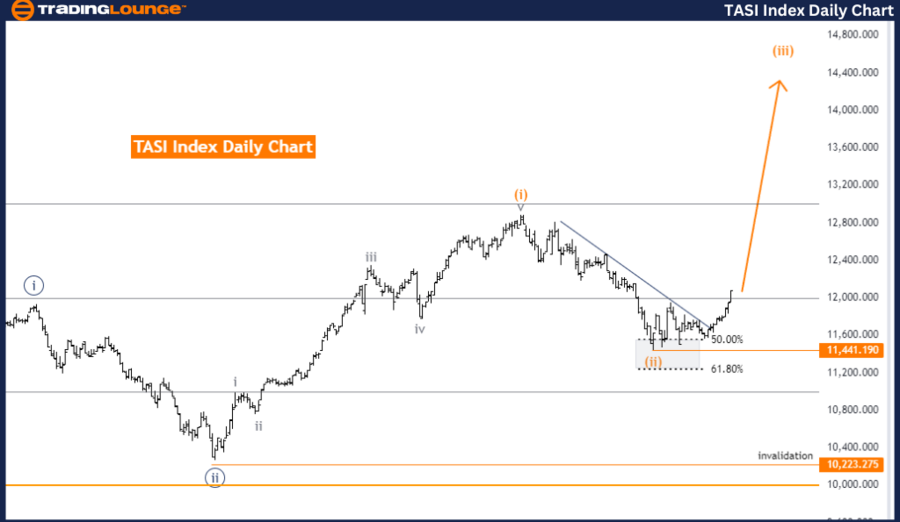

TradingLounge TASI Index Elliott Wave Analysis - Day Chart

TASI Index Day Chart Analysis

TASI Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange wave 3 (started)

Details: Orange wave 2 appears completed. Now, orange wave 3 of 3 is in play.

Wave Cancel Invalid Level: 10223.275

Analysis Summary: The TASI Index Elliott Wave Analysis for the daily chart offers detailed insights into the current market trend and wave structure. This technical analysis highlights a trend function, suggesting a clear market direction rather than a corrective phase.

Current Wave Structure: Identified as orange wave 3, which is part of a larger navy blue wave 3.

- This indicates that the market is in the midst of an impulsive wave phase, characterized by strong and decisive trend movement.

- The market is positioned within navy blue wave 3, indicating an ongoing and active wave phase.

Next Direction in Wave Sequence: Continuation of orange wave 3, which has already commenced.

- Following the completion of orange wave 2, the analysis suggests that the trend will persist through orange wave 3 of 3.

- This phase is crucial as it represents a significant part of the overall trend movement.

Invalidation Level: Set at 10223.275.

- This level serves as a benchmark for validating or invalidating the current wave count.

- If the market price falls below this level, the current wave analysis would be invalid, necessitating a reassessment of the market's condition.

- This invalidation level is essential for risk management and confirming the wave count's accuracy.

In summary, the TASI Index daily chart analysis identifies the market as being in an impulsive trend phase within orange wave 3, part of a larger navy blue wave 3. The analysis expects the trend to continue through orange wave 3 of 3, following the completion of orange wave 2. The wave cancellation invalid level at 10223.275 is crucial for maintaining the validity of the current wave analysis and for effective risk management.

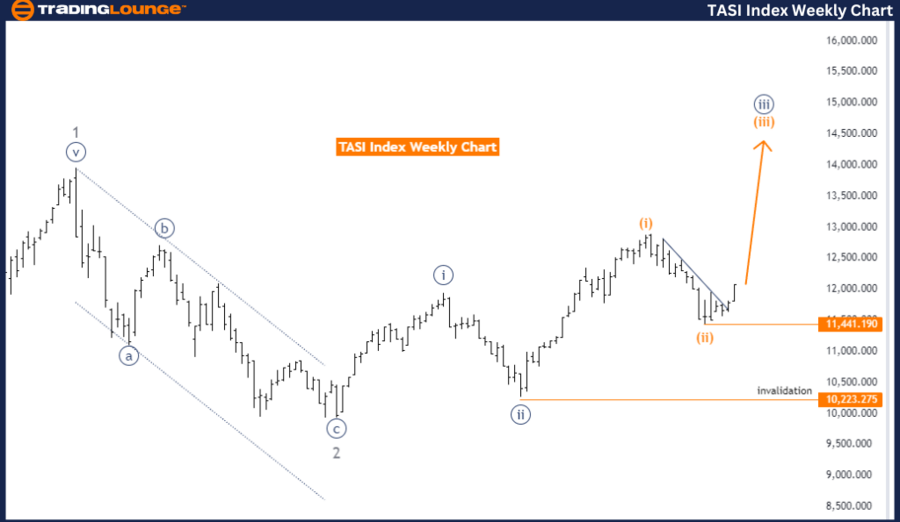

TradingLounge TASI Index Elliott Wave Analysis - Weekly Chart

TASI Index Weekly Chart Analysis

TASI Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 3

Next Higher Degree Direction: Orange wave 3 (started)

Details: Orange wave 2 appears completed. Now, orange wave 3 of 3 is in play.

Wave Cancel Invalid Level: 10223.275

Analysis Summary: The TASI Index Elliott Wave Analysis for the weekly chart provides an in-depth look at the current market trend and wave structure. The primary function of this analysis is to track the trend, indicating a clear directional movement in the market.

Current Wave Structure: Identified as orange wave 3, which is part of a broader navy blue wave 3.

- This suggests that the market is experiencing a significant and strong movement typical of an impulsive wave phase.

- The market is positioned within navy blue wave 3, indicating an ongoing and substantial portion of the overall trend movement.

Next Direction in Wave Sequence: Continuation of orange wave 3, which has already commenced.

- Following the completion of orange wave 2, the analysis indicates that the market trend will likely persist through orange wave 3 of 3.

- This phase is critical as it represents a continuation of the strong trend movement that defines the impulsive wave.

Invalidation Level: Set at 10223.275.

- This level acts as a key reference point for validating or invalidating the current wave count.

- If the market price falls below this level, it would invalidate the current wave analysis, necessitating a reassessment of the market's wave structure.

- This invalidation level is essential for risk management and ensuring the wave analysis's accuracy.

In summary, the TASI Index weekly chart analysis identifies the market as being in an impulsive trend phase within orange wave 3, which is part of a larger navy blue wave 3. The analysis expects the trend to continue through orange wave 3 of 3, following the completion of orange wave 2. The wave cancellation invalid level at 10223.275 is crucial for maintaining the validity of the current wave analysis and for effective risk management.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Hang Seng Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support