TradingLounge Soybean Commodity Elliott Wave Analysis

Soybean is currently experiencing a correction within its long-term bullish trend. The commodity has undergone a significant sell-off, shedding over 45% of its value since peaking at 1784 in June 2022. This sell-off appears to be nearing its final stages. The critical question now is: how much further could prices decline before a substantial reversal occurs?

Soybean Elliott Wave Technical Analysis - Long-Term Perspective

Before the downturn that started in June 2022, Soybean completed a bullish impulse wave structure that began in May 2019, when prices were at $806. Over the past 26 months, more than two-thirds of those gains have been retraced. From an Elliott Wave standpoint, this corrective phase is forming into a typical three-swing pattern, common in most corrective structures.

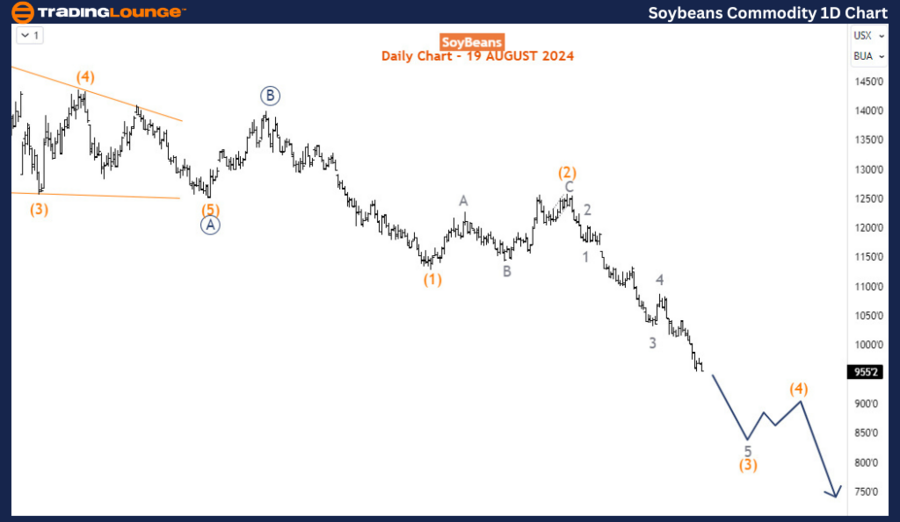

Soybean Daily Chart Analysis

On the daily chart, the emerging pattern is analyzed from the primary wave degree (circled). Wave A (circled) concluded at 1249 in October 2023, and Wave B (circled) ended at 1398 in November 2023. Currently, Wave C (circled) is unfolding to the downside. Within this wave, sub-waves (1) and (2) of 5 (circled) have been completed, with the price now progressing in Wave (3). The price has broken below the critical 1,000 level and could potentially decline to 800 before Wave (3) concludes. This movement is part of Wave 5 of (3), suggesting that the bearish phase may not be over yet. In the near term, further selling pressure is expected.

Soybean H4 Chart Analysis

On the H4 chart, Wave 5 appears to be in its 3rd sub-wave, labelled as Wave iii (circled) of 5. This indicates that Soybean is likely to continue its downward movement in the near term, favouring further sell-offs.

Conclusion

Soybeans is in the latter stages of a corrective phase following a long-term bullish trend. While the sell-off has been substantial, Elliott Wave analysis suggests that there may be further downside before a significant reversal occurs. Traders should remain cautious of continued selling pressure in the near term, as the bearish phase may still have more ground to cover before a bottom is established.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Natural Gas Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support