ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis (1D Chart)

Welcome to today's Elliott Wave analysis of the Australian Stock Exchange (ASX) V300AEQ ETF UNITS – VAS. Our analysis indicates that VAS may have completed wave 2-grey, with wave 3-grey now unfolding, potentially pushing prices higher.

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

VAS Elliott Wave Technical Analysis

Trend Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details: From the low at 94.13, wave 3-grey is progressing higher, subdividing into wave ((iii))-navy. The next target is 105.50, and potentially higher. Price needs to stay above 98.39 to confirm this upward trend.

Invalidation Point: 98.39

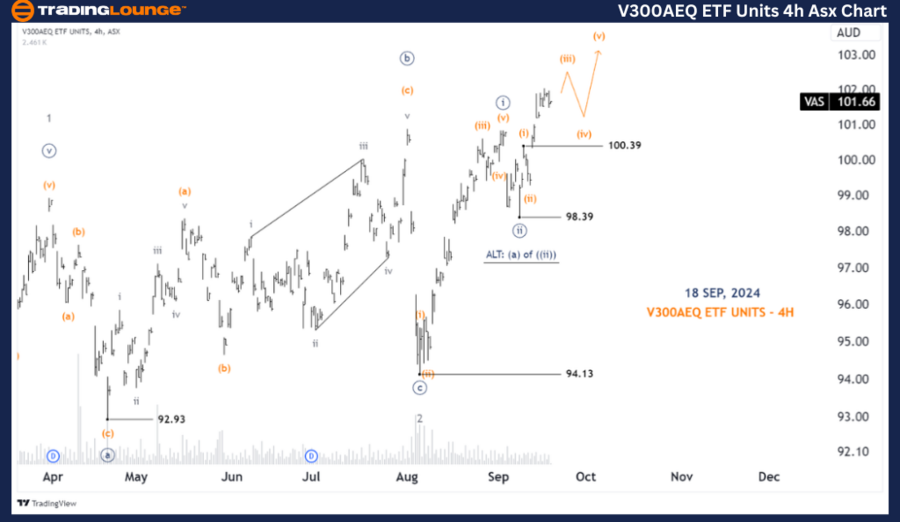

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

VAS Elliott Wave Technical Analysis

Trend Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Details: Since the low at 98.39, wave ((iii))-navy is progressing higher and subdividing into wave (iii)-orange. Once this wave completes, wave (iv)-orange could see a minor retracement, followed by wave (v)-orange, which is expected to push prices higher. Price must stay above 100.39 to sustain this bullish outlook.

Invalidation Point: 100.39

Conclusion

Our Elliott Wave analysis of ASX: V300AEQ ETF UNITS – VAS highlights key trends and price movements. By identifying critical price levels and potential targets, we aim to equip traders with actionable insights. The validation and invalidation points provided increase confidence in our wave count, offering a well-rounded perspective for those looking to capitalize on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: BRAMBLES LIMITED – BXB Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support