Since reaching its record high of 11,722 in April 2024, cocoa prices have undergone a correction, moving lower. In the months following this peak, the commodity lost around 40% of its value. The recent sell-off appears to be correcting the bullish impulse sequence that began in September 2022.

Cocoa Commodity Daily Chart Analysis

The daily chart shows a completed impulse wave rally starting in September 2022, peaking at the 11,722 level in April 2024. From that high, prices have been in a correction phase. This downward movement follows a double zigzag corrective structure.

- Wave W completed in August 2024, followed by a Wave X bounce, which ended in late September 2024.

- Now, the focus shifts to Wave Y, which is expected to extend downward, with a potential target near the 5,000 support level.

Alternative Elliott Wave Scenario

In case the decline stops above 6,000, followed by another corrective bounce, it may suggest a leading diagonal pattern in Wave A of the decline from 11,722. The bounce would then be Wave B, setting the stage for a Wave C decline toward 5,000 or lower. This scenario supports the medium-term bearish outlook for cocoa prices.

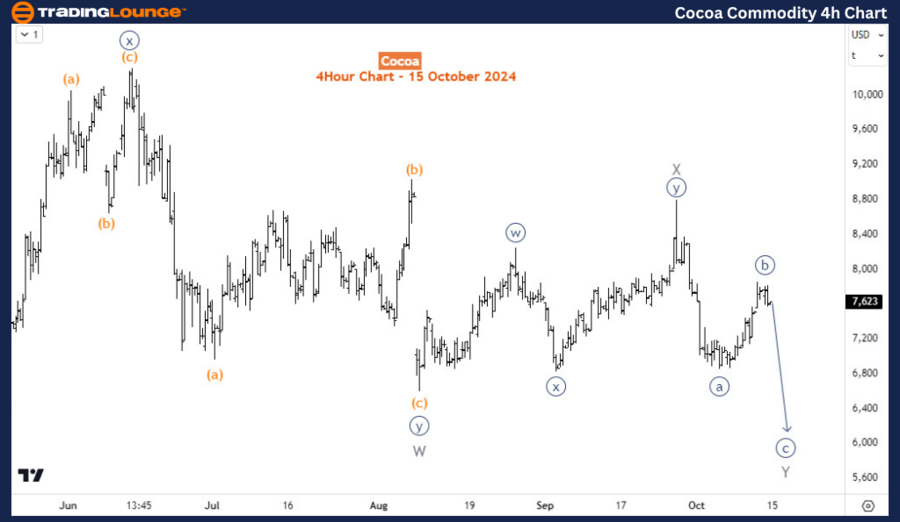

Cocoa Commodity H4 Chart Analysis

On the 4-hour chart, the current bounce represents Wave ((b)) of Y. Once this bounce completes, Wave ((c)) of Y should follow, with 5,000 or lower as a likely target.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support