MCD Elliott Wave Analysis: McDonald’s Corp. (MCD) - Daily and 1-Hour Charts

This analysis examines McDonald's Corp. (MCD) from both the daily and 1-hour chart perspectives, applying Elliott Wave Theory to identify current trends and predict future price movements.

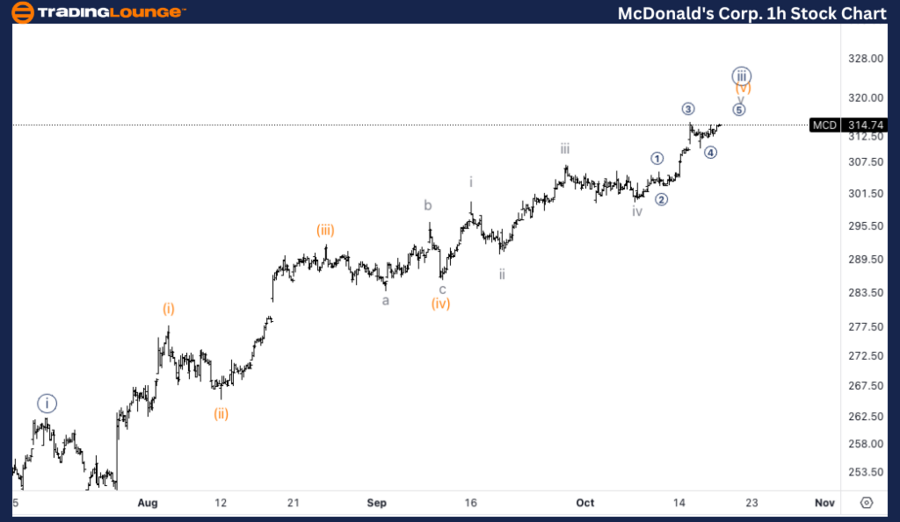

MCD Elliott Wave Analysis – Tradinglounge Daily Chart

McDonald’s Corp. (MCD) Daily Chart

MCD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (1)

Direction: Upside

Details: The daily chart shows McDonald's in Wave 1 of (1), signaling the start of an impulsive move after a prolonged correction in Primary Wave 4. This correction seems to have bottomed, leading to a strong upside movement. This marks the early stages of a new bullish phase, with further upside potential as Wave 1 continues to develop.

MCD Stock Technical Analysis – Daily Chart Overview

McDonald’s has entered a bullish phase in Wave 1 of (1) after completing a lengthy correction in Primary Wave 4. The daily chart suggests a strong upside thrust as this new impulsive wave unfolds. Traders should watch for further upward momentum as Wave 1 progresses.

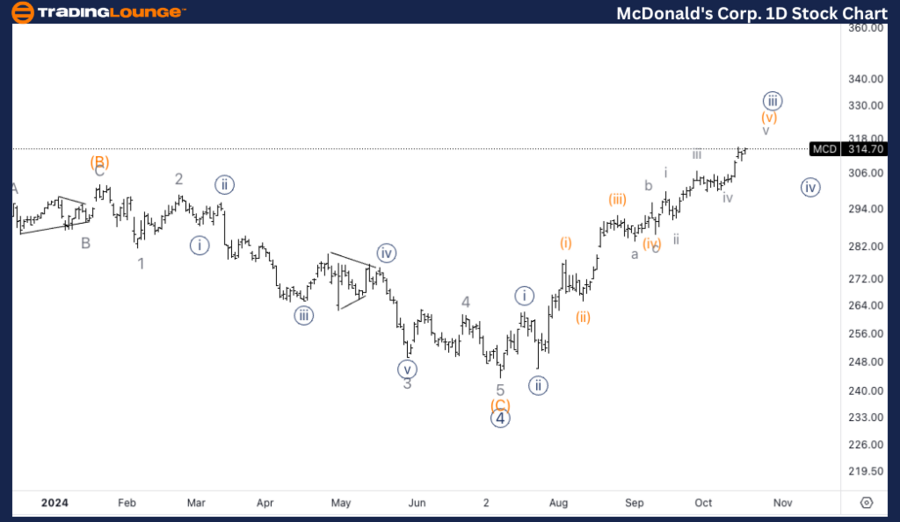

MCD Elliott Wave Analysis – 1-Hour Chart

McDonald’s Corp. (MCD) 1-Hour Chart

MCD Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Upside

Details: The 1-hour chart shows McDonald's in Wave {iii} of 1, with further upside likely. This subdivision of Minute Wave {iii} suggests that the wave is nearing a potential top, likely around the middle of MinorGroup1, near the $320 level. After this peak, a brief corrective phase may occur before resuming the broader bullish trend.

MCD Chart Technical Analysis – 1-Hour Chart Overview

Wave {iii} of 1 in McDonald's 1-hour chart appears to be approaching a top around the $320 mark. Once this top is reached, traders can anticipate a small corrective phase before the bullish trend continues. Keep an eye on the price action near this level for potential short-term pullbacks.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Deere & Co. (DE) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support