Salesforce Inc. (CRM) Elliott Wave Analysis: Current Trend Overview

This analysis examines Salesforce Inc.'s (CRM) current trend structure using Elliott Wave Theory, covering both daily and 1-hour charts. The following breakdown highlights CRM's stock position and its potential future movements.

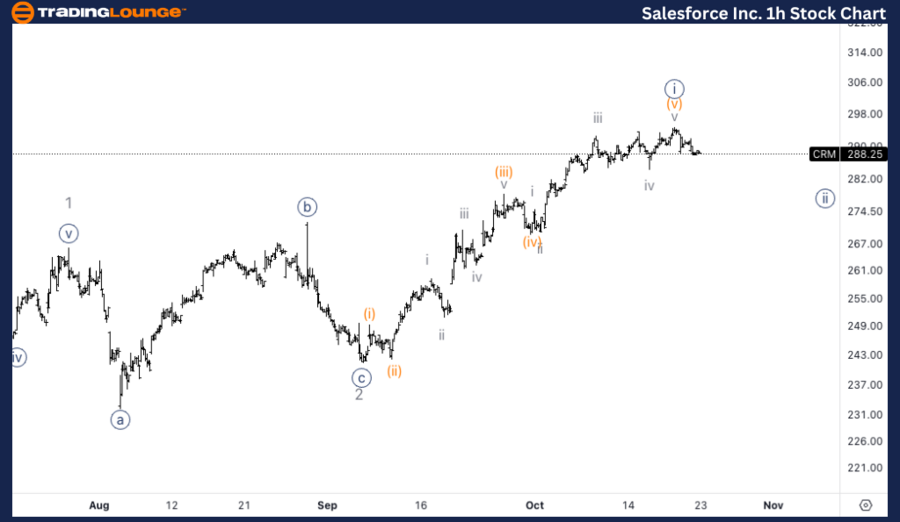

CRM Elliott Wave Analysis - TradingLounge Daily Chart Overview

Salesforce Inc. (CRM) Daily Chart

CRM Elliott Wave Technical Analysis

Details: Salesforce (CRM) shows a potential bottom forming above $200. The stock is expected to rise within wave 3, signaling further upward movement as the current impulsive wave structure continues to unfold.

CRM Elliott Wave Technical Analysis – Daily Chart Breakdown

On the daily chart, Salesforce (CRM) may have established a key bottom above $200. The current Elliott wave structure suggests that the stock is in the early phases of wave {iii}, which is part of a larger impulsive pattern. As wave 3 progresses, there is potential for significant upside momentum.

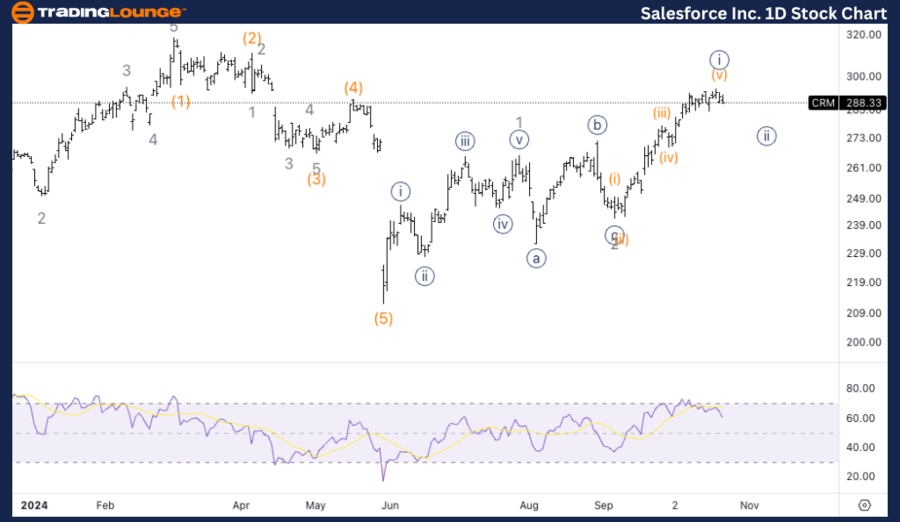

Salesforce Inc. (CRM) 1-Hour Chart Analysis

CRM Elliott Wave Technical Analysis

-

Function: Trend

-

Mode: Impulsive

-

Structure: Motive

-

Position: Wave {i} of 3

- Direction: Approaching top in wave {i}

Details: As Salesforce approaches the top of wave {i} of 3, the Relative Strength Index (RSI) indicates overbought conditions. The stock is nearing TradingLevel3 at $300, and a pullback is likely. Following this retracement, a ClassicTradingLevelPattern may emerge, supporting continued upward movement in wave {iii} of 3.

CRM Elliott Wave Technical Analysis – 1-Hour Chart Breakdown

On the 1-hour chart, Salesforce is nearing the completion of wave {i} of 3. The RSI shows signs of a potential short-term top as the stock price approaches TradingLevel3 at $300. A retracement may occur, forming a ClassicTradingLevelPattern. After this pullback, the upward trend is expected to resume within wave {iii} of 3.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Coca-Cola Company Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support