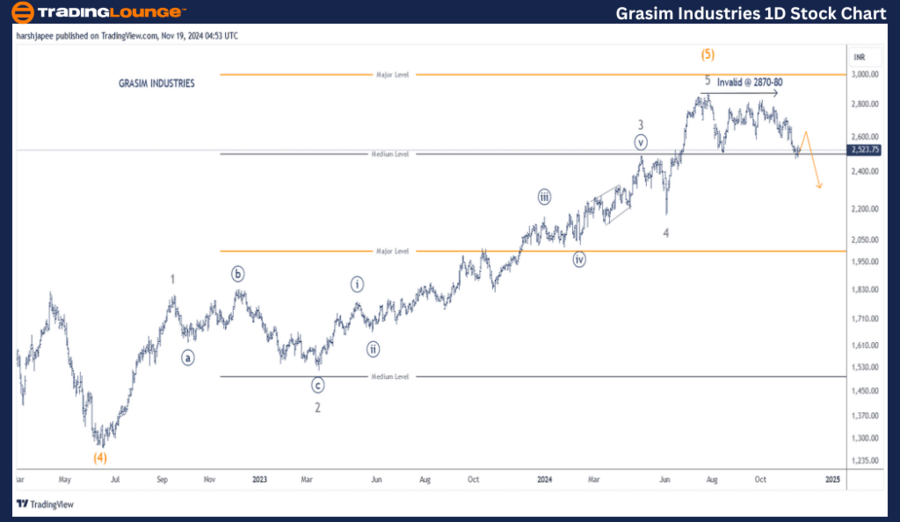

GRASIM INDUSTRIES – GRASIM Elliott Wave Analysis (1D Chart)

GRASIM Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Potential Zigzag

Position: Still unfolding, not labeled yet

Details:

Invalidation Point: 2880

GRASIM INDUSTRIES Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of GRASIM INDUSTRIES suggests the larger degree (Intermediate) uptrend might have reached its termination point near the 2880 level. The stock appears to be in the early stages of forming a larger degree corrective wave. The medium-term target aligns with a move toward the 2170 support level.

Key Observations:

-

Intermediate Wave (4) concluded near 1270 in June 2022.

-

The subsequent rally subdivides into five waves (Minor 1 through 5) culminating at the 2880 level.

-

If accurate, this setup indicates a bearish inclination to initiate a corrective wave of a larger degree, with a downside target of approximately 2170.

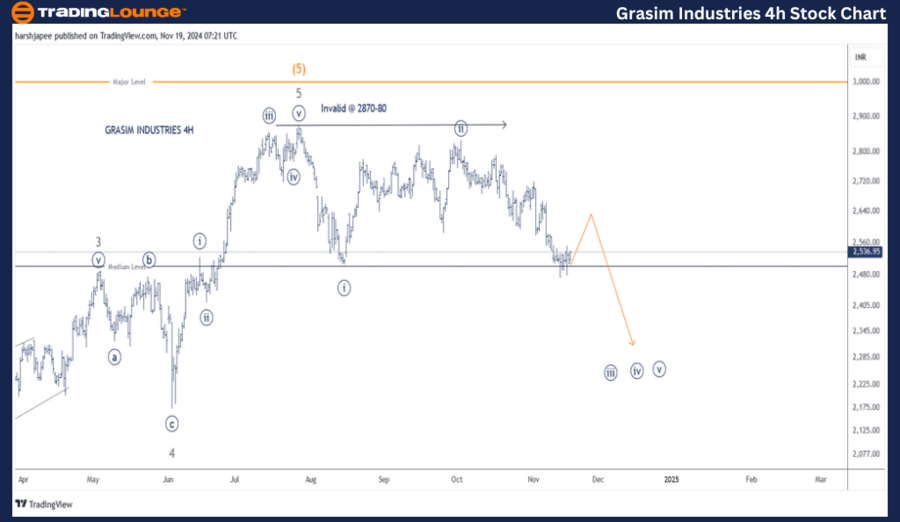

GRASIM INDUSTRIES Elliott Wave Technical Analysis (4H Chart)

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Potential Zigzag

Position: Minute ((ii)) Grey on the 4H chart

Details:

-

A Minor degree zigzag may be unfolding against the 2880 resistance.

-

Minute Wave ((i)) and ((ii)) appear to have completed on the 4H chart, potentially forming Minor Wave A of the projected zigzag pattern.

-

Short-term projections suggest a pullback toward the 2600-2620 range before the next move lower.

Invalidation Point: 2880

GRASIM INDUSTRIES 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart of GRASIM INDUSTRIES shows:

- Termination of Minor Wave 3 Grey near the 2510-2520 range.

- Minor Wave 4 formed a sharp zigzag, followed by an impulsive move completing Minor Wave 5 of (5) near 2880.

- Minute Waves ((i)) and ((ii)) potentially concluded around 2500 and 2835, respectively, though these are yet to be marked on the daily chart.

- If the analysis is accurate, Minute Wave ((iii)) could now be progressing with resistance at 2880.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASIAN PAINTS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

GRASIM INDUSTRIES may have concluded Intermediate Wave (5) Orange near 2880. The stock is likely in the process of initiating a larger corrective wave. Key downside targets include the 2600-2620 range in the short term and 2170 in the medium term.