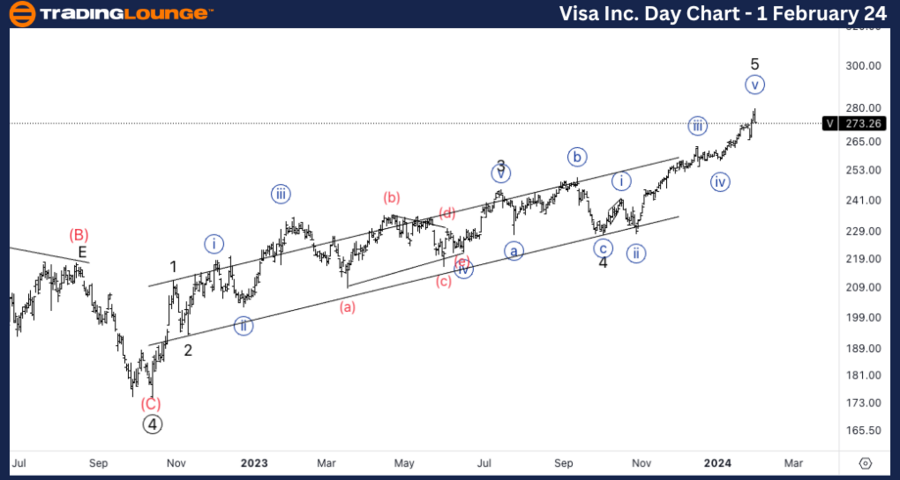

Visa (V) Elliott Wave Analysis Trading Lounge Daily Chart, 1 February 24

Visa Inc., (V) Daily Chart

Visa Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minute wave {v} of 5.

DIRECTION: Top in wave 5.

DETAILS: Potential top in place in wave 5 as we reached 280$. There is a possibility we will continue higher, nevertheless we could expect strong resistance at 300&.

Technical Analyst: Alessio Barretta

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

See Previous: Eli Lilly & Co., (LLY)

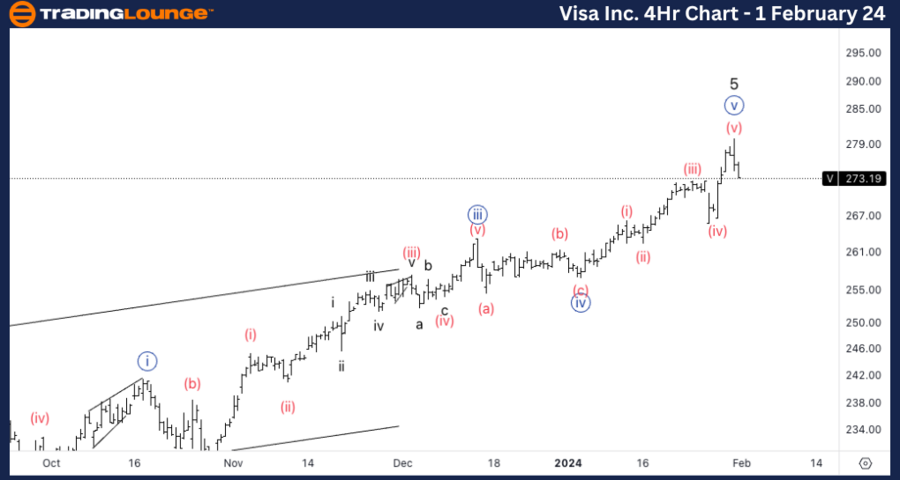

V Elliott Wave Analysis Trading Lounge 4Hr Chart, 1 February 24

Visa Inc., (V) 4Hr Chart

V Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave {i} of A.

DIRECTION: Downside into wave {i}.

DETAILS: Looking for acceleration lower to confirm the overall bearish count. We would need to break the bottom of wave (iv) to have additional confirmation.

Welcome to our V Elliott Wave Analysis Trading Lounge, providing insights into Visa Inc. (V) based on Elliott Wave Technical Analysis. As of the Daily Chart on 1st February 2024, we observe a significant development in the trend.

V Elliott Wave Technical Analysis – Daily Chart

In terms of the wave function, we identify a prevailing impulse mode characterized by a motive structure. The current position is in Minute wave {v} of 5, indicating a potential top at $280. While the possibility of further upward movement exists, it's crucial to note the anticipated strong resistance around $300.

V Elliott Wave Technical Analysis – Daily Chart

Shifting our focus to the 4Hr Chart on the same date, we analyze Visa Inc. (V) through the lens of Elliott Wave Technical Analysis.

Here, the wave function takes a counter trend stance with a corrective mode, manifesting a zigzag structure. The present position is in Wave {i} of A, suggesting a downside trajectory into wave {i}. To validate the overall bearish outlook, we are actively monitoring for an acceleration lower, awaiting confirmation through a break below the bottom of wave (iv).

Stay tuned for updates as we navigate the dynamic landscape of Visa Inc. (V) using Elliott Wave Analysis. Our expert analysis aims to provide you with valuable insights for informed trading decisions in this ever-evolving market.