Function - Counter-trend

Mode - Corrective

Structure - Diagonal

Position - Blue wave a of Y of (B)

Direction - Blue wave b of Y of (B)

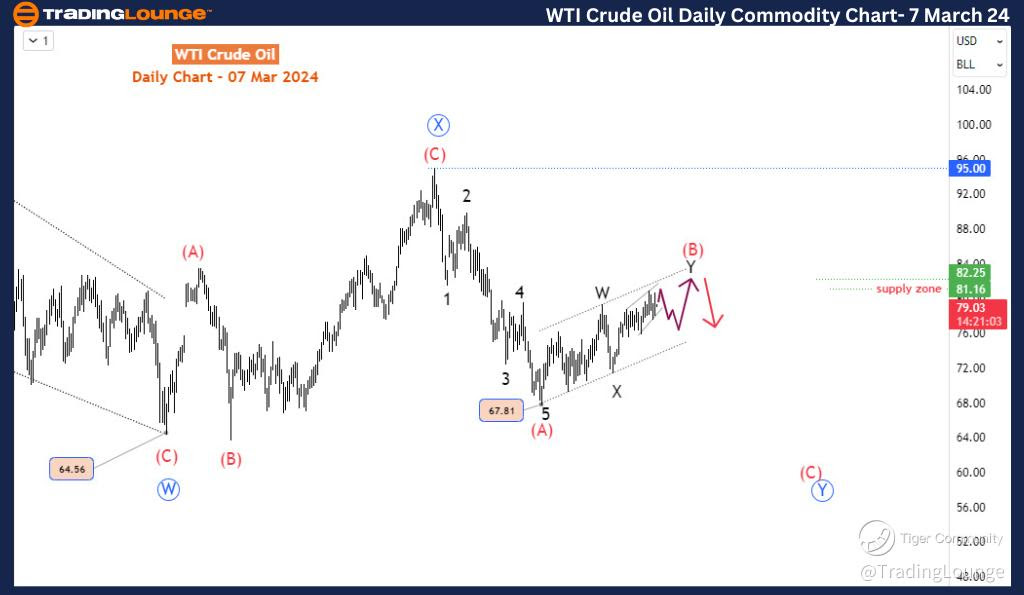

WTI Crude has witnessed a remarkable 16% surge since mid-December, yet this resurgence is indicative of a corrective phase. As traders, it's crucial to pinpoint the probable price levels where significant selling pressure might trigger a shift towards the bearish trend dominant in late 2023. Through Elliott wave analysis, we aim to dissect the nature of this corrective drive, assess its potential extent, and identify plausible termination points.

On the daily timeframe, the $95 peak reached in late September signaled the completion of a primary degree wave X, characterized by an expanding flat pattern. This milestone marked the culmination of the second leg of a double zigzag pattern within the primary degree. Subsequently, the focus shifted towards anticipating the onset of the final leg - primary degree wave Y. The price action post-$95 corroborated this projection, with wave (A) of Y materializing into a bearish impulse down to $67.81. The ensuing bullish correction has evolved into a double zigzag wave (B) of Y, poised to pave the way for wave (C) and subsequent downward movements below $60. This succinctly encapsulates a plausible medium-term Elliott wave forecast for WTI crude. However, it appears that wave (B) is yet to reach completion, necessitating further scrutiny of the evolving corrective rally on the 4-hour chart.

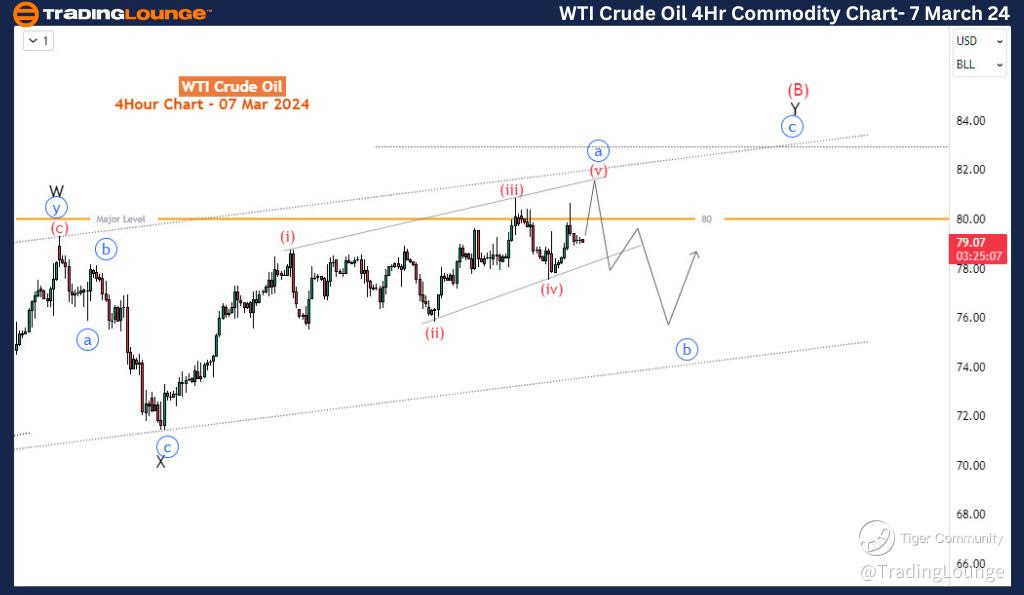

WTI Crude Oil 4Hr Chart Analysis

Zooming in on the H4 chart, minor degree waves W and X of (B) have concluded their trajectories. Wave Y, envisaged as a zigzag pattern, is now unfolding. Post-wave X, price action exhibits characteristics of a diagonal pattern, aligning with the minute degree sub-wave 'a' of Y. This diagonal appears to be nearing completion, with wave (v) of a (minor degree in blue) approaching around the $80 mark, a significant psychological level. Anticipate a subsequent bearish price action post-diagonal completion, likely prompting a corrective wave b downwards, while still maintaining levels above the wave (X) low. This sets the stage for potential bullish opportunities in minute wave y of Y. Wave c of Y of (B) is anticipated to mark the denouement of wave (B), with substantial bearish momentum anticipated below $60.

Conclusion: In essence, WTI Crude finds itself amidst a medium-term corrective rally, poised to conclude within the next two legs. Prepare for a notable sell-off post-completion, as the market dynamics shift towards a bearish trajectory. Stay informed, stay vigilant, and capitalize on the insights gleaned from Elliott wave analysis to navigate the fluctuations of the WTI Crude market with precision and confidence.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Commodity

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.