UNIUSD Elliott Wave Analysis TradingLounge Daily Chart, 8 March 24,

In the realm of cryptocurrency trading, understanding Elliott Wave Theory can unlock profitable opportunities. UNIUSD, the Uniswap token paired with the U.S. dollar, exhibits an intriguing Elliott Wave pattern as of 8th March 2024.

UNIUSD Elliott Wave Technical Analysis

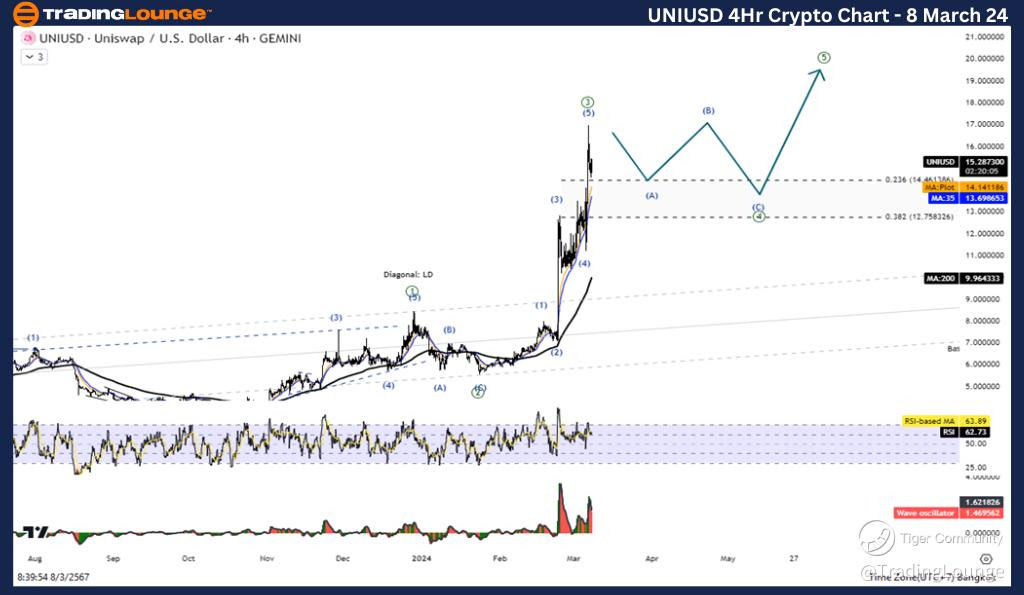

Uniswap/U.S. dollar (UNIUSD) 4-hour Chart Analysis

Function: Following Trend

Mode: Motive

Structure: Impulse

Position: Wave ((3))

Direction Next Higher Degrees: Wave I of Impulse

Wave Cancel Invalid Level: 4.50

Details: Wave 3 may be complete, watch out for the Corrective phase

UNIUSD Trading Strategy:

UNIUSD remains entrenched in its Wave 3 rally, signaling further potential upside. With Wave 4 decline and Wave 5 rally pending, the overall sentiment remains bullish. The continuous upward trend presents compelling opportunities for traders to capitalize on.

UNIUSD Technical Indicators:

Observing technical indicators is crucial for informed trading decisions.

- Price Action: UNIUSD is trading above the MA200, indicating a robust uptrend.

- Wave Oscillator: Bullish momentum persists, supporting the bullish outlook.

Unlocking Profit Potential with UNIUSD Elliott Wave Analysis

Uniswap/U.S. dollar (UNIUSD) 4-hour Chart Analysis

Uniswap/U.S. dollar Elliott Wave Technical Analysis

Delving deeper into the 4-hour chart of UNIUSD reinforces the bullish sentiment prevailing in the market.

Function: Following Trend

Mode: Motive

Structure: Impulse

Position: Wave ((3))

Direction Next Higher Degrees: Wave I of Impulse Wave Cancel Invalid

Level: 4.50

Details: Wave 3 may be complete, watch out for the Corrective phase

Uniswap/U.S. dollar (UNIUSD) Trading Strategy:

Building upon the daily chart analysis, the 4-hour chart reaffirms the bullish trajectory of UNIUSD. As Wave 3 potentially concludes, traders should remain vigilant for corrective movements. However, the overall sentiment remains optimistic, offering traders ample opportunities for profitable trades.

Uniswap/U.S. dollar (UNIUSD) Technical Indicators:

- Price Action: The MA200 continues to act as a strong support, reinforcing the uptrend bias.

- Wave Oscillator: Bullish momentum persists, validating the bullish outlook for UNIUSD.

In Conclusion:

UNIUSD presents an enticing landscape for traders, with Elliott Wave analysis offering valuable insights into market dynamics. By adhering to trend-following strategies and closely monitoring technical indicators, traders can unlock the profit potential inherent in UNIUSD trading. Stay vigilant, stay informed, and seize the opportunities presented by UNIUSD's bullish momentum.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Ethereum/ U.S. Dollar (ETHUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.