Global X Uranium ETF (URA) Elliott Wave Analysis

Function: Countertrend

Mode: Corrective

Structure: Zigzag for Wave 4; Impulse for Wave (A)

Position: Wave 5 of Wave (A)

Direction: Wave 5 of Wave (A) is still unfolding

Details: The blue wave 4 triangle is completed, confirmed by the break above wave (B) high. Wave '5' has begun its upward movement. The invalidation level is now set at the wave (E) low. Price could retest the 30 major level before wave '5' of the blue wave series continues.

URA Elliott Wave Technical Analysis

The GX URA ETF, known as the Global X Uranium ETF, is an investment vehicle that reflects the performance of firms in the uranium industry. It provides a diversified portfolio of global companies engaged in uranium mining, exploration, and production. As nuclear power garners interest as a cleaner energy source, with a potential uptick in uranium demand, the GX URA ETF offers investors a unique opportunity to tap into the sector's growth.

After a three-month sideways movement, the URA ETF is attempting an upward breakout. Traders are adding LONG positions and closing SHORT positions to extend the bullish impulse that started in August 2022. The price is anticipated to aim for a new high in 2024, potentially surpassing the February 2024 peak, according to Elliott Wave projections.

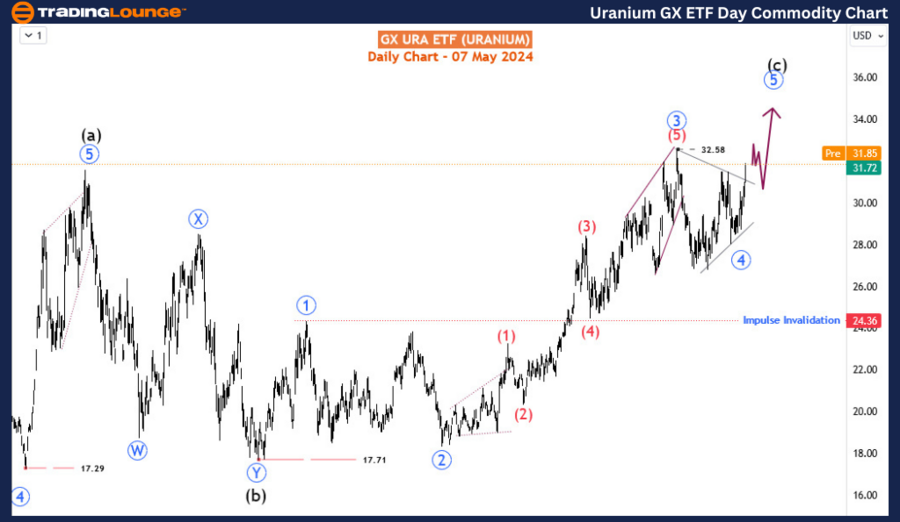

GX Uranium ETF (URA) Day Chart Analysis:

The daily chart reveals a clear bullish impulse wave pattern beginning at 17.71 in August 2022. It completed the 3rd wave - primary wave 5 (marked in blue) in February 2024 and then moved sideways to form a triangle for the 4th wave - blue wave 4. The blue wave 5 is emerging and is anticipated to reach a new yearly high.

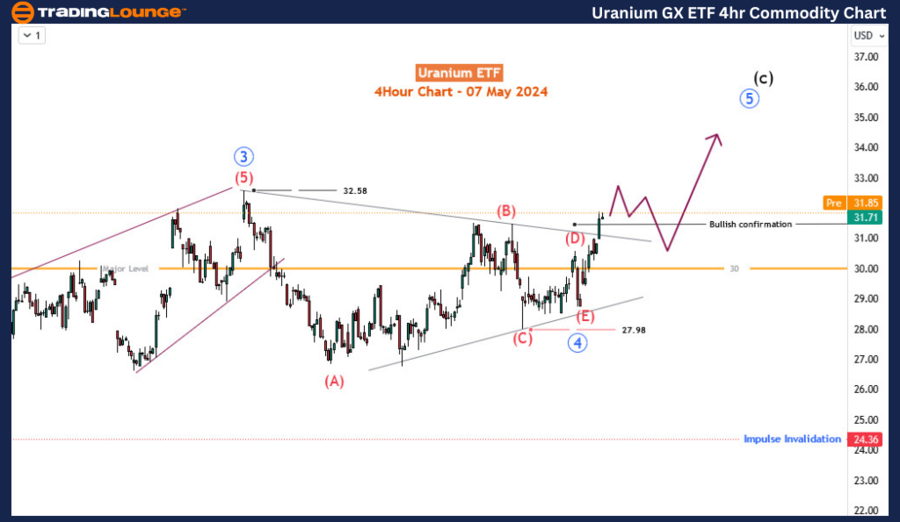

GX Uranium ETF (URA) 4-Hour Chart Analysis:

The H4 chart illustrates the sub-waves of the triangle 4th wave, divided into five 3-wave patterns between two contracting lines. The primary degree wave 5 (marked in blue) is projected to advance toward 36-36. However, the price could dip toward the 30.00 major level before the rally progresses further. This projection holds as long as the price remains above the 27.98 major level.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Commodity Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 6 Analysts covering over 150 Markets. Chat Room With Support