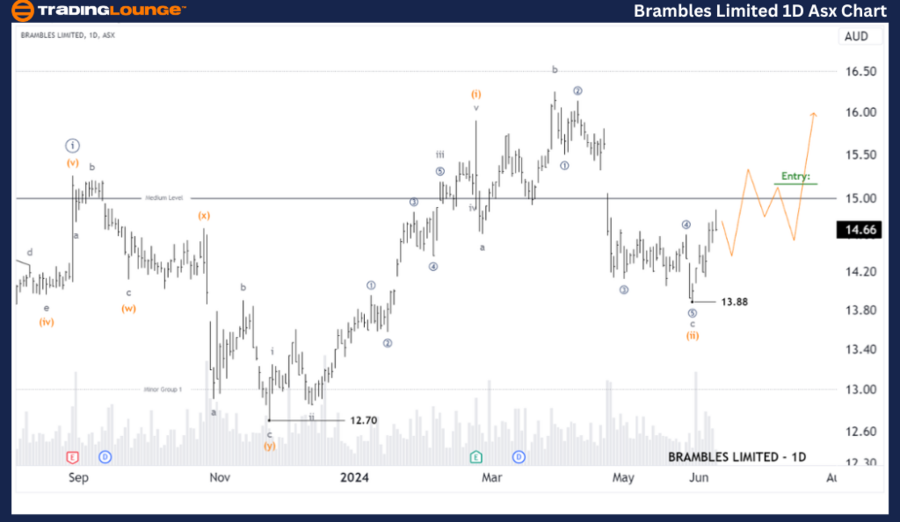

ASX: BRAMBLES LIMITED - BXB Elliott Wave Analysis by TradingLounge (1D Chart)

Greetings, today's Elliott Wave analysis focuses on BRAMBLES LIMITED (ASX: BXB). Our current assessment indicates that BXB has likely completed wave (ii)-orange, though a further rise is needed to confirm this. We anticipate wave (iii)-orange may soon push higher.

ASX: BRAMBLES LIMITED - BXB Elliott Wave Technical Analysis

BXB 1D Chart (Semilog Scale) Analysis:

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange

Details: The short-term outlook suggests that wave (ii)-orange has ended, with wave c-grey fully breaking down into 5 waves. These positions wave (iii)-orange to potentially push higher.

Invalidation point: 13.88

ASX: BRAMBLES LIMITED - BXB Elliott Wave Technical Analysis (4-Hour Chart)

ASX: BRAMBLES LIMITED - BXB Elliott Wave Technical Analysis

BXB 4-Hour Chart Analysis:

Function: Major trend (Subminuette degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((4))-navy of Wave i-grey

Details: The shorter-term outlook shows wave (iii)-orange unfolding higher, subdividing into wave i-grey, nearing completion. Subsequently, wave ii-grey is expected to dip slightly before wave iii-grey advances. A Long Trade Setup will be considered when the Medium Level 15.00 turns into support.

Invalidation point: 13.88

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX LIMITED - ASX Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion

Our analysis and forecast for ASX: BRAMBLES LIMITED - BXB aim to provide actionable insights into current market trends. Specific price points serve as validation or invalidation signals for our wave count, bolstering our perspective's reliability. By integrating these elements, we offer an objective and professional market trend analysis.